Historically, recessions in Australia often reflect downturns in the US and world economy, although are mitigated or exacerbated by domestic policy responses. While much has been made of Australia’s ability to avoid a recession (as conventionally defined) since 1991, Australia has not escaped the global business cycle. The Australian economy still experienced a significant downturn during the global financial crisis and a two percentage point increase in the unemployment rate. Australia never recovered its pre-GFC unemployment rate of 4 per cent, which now stands at 5.1 per cent.

The current situation is unusual in that the pandemic is a truly global shock, effecting the Australian economy as well as the rest of the world, more or less simultaneously and in similar ways. Australia’s relative success in suppressing the pandemic at home will still leave it exposed to its economic effects abroad. In particular, the downturn in the US economy can be expected to have an impact on Australia.

Up until the mid-2000s, the Australian Reserve Bank modelled Australian GDP on the basis of a long-run relationship with US GDP. The two economies grew together and went into recession together. This relationship weakened from 2001, when the US economy went into recession, but the Australian economy did not. The Australian economy also outperformed during the GFC. While the relationship has weakened since the mid-2000s, the US business cycle still has an influence on the Australian economy.

The effort to suppress the pandemic in the United States is taking a heavy toll on the US economy. In the week that ended on 4 April, a further 6.6 million Americans filed for unemployment claims, bringing the total over the preceding three weeks to almost 17 million. For the week ended 28 March, 7.5 million Americans were already drawing unemployment benefits, a figure well in excess of the previous peak seen in 2009. As I noted previously, as many as 53 million Americans could be out of work by the second quarter of this year.

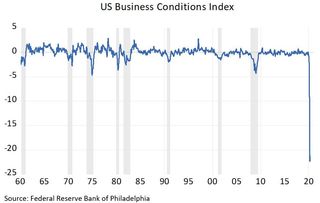

The Federal Reserve Bank of Philadelphia hosts a real-time measure of the US economy, the Business Conditions Index, which is updated at a daily frequency, based on the most recently released data. Positive values indicate above-average economic conditions, negative values below average conditions. The index as at 31 March is shown in the figure below. The vertical grey shaded areas are periods of recession as defined by the National Bureau of Economic Research.

The index on 31 March is showing an unprecedented collapse in economic activity. The two worst downturns in the US economy since 1960 were in 1974 and 2009, when the index recorded a reading around -4.4. The most recent reading is -21, having started the year close to zero – its long-run average.

We can use the US BCI to look at how the US economy is correlated with the Australian economy. Since the US BCI is expressed as a deviation from a zero mean, I estimate the percentage deviation of the level of Australian GDP from its potential (also known as an output gap) and compare it to the BCI in the figure below.

The correlation between US business conditions and the Australian output gap is evident in the figure, although there are episodes where the Australian economy both outperformed and underperformed the US economy. The US data is lagged two quarters. The final value shown for the US BCI is the average for the March quarter (-8 rather than -21) and is not fully shown in the graph.

The graph suggests the Australian economy will see a drag from the US economy within two quarters, on top of the domestic downturn. Obviously, much depends on how quickly both Australia and the United States get on top of the pandemic. There are historical precedents for rapid, V-shaped recoveries from recession, especially in the United States. But even if Australia were to suppress the pandemic quickly, it could still face significant headwinds from the US economy if US efforts are less successful.

Note: the estimated Australian output gap is based on Kamber, Morley and Wong’s modified Beveridge-Nelson filter with a dynamic mean adjustment based on a 40 quarter rolling backward window to capture changes in Australia’s trend growth rate. See Kamber G., Morley J., and Wong B. (2018) “Intuitive and reliable estimates of the output gap from a Beveridge-Nelson filter,” The Review of Economics and Statistics, 100(3).