Executive summary

Despite much attention focused on the disruptive economic approaches of the Donald Trump administration towards China, it is the latter which remains far more restrictive, self-regarding and predatory when it comes to policies regarding industry, market access, innovation and the exchange of people and ideas. The Chinese Communist Party has long sought to strike an unequal and unfair bargain with the United States and other countries when it comes to participation in the global economic system.

This is the context in which the determination in the United States to diversify, disentangle and even decouple supply and value chains from China takes place — a sentiment which is growing stronger and becoming more broad-based as the United States becomes the new epicentre for COVID-19. Furthermore, this sentiment will remain even if there is a new president in the White House in 2021.

This raises complex questions about what these three Ds mean: what is feasible, probable and unlikely when it comes to economic separation between these two countries.

This report argues that lowering reliance on China as the central hub for the manufacture of parts and assembly of products for many traditional and current generation merchandise products will be difficult or impossible to shift.

This report argues that lowering reliance on China as the central hub for the manufacture of parts and assembly of products for many traditional and current generation merchandise products will be difficult or impossible to shift. In this context, shifts out of China will only be gradual.

However, the list of strategic or critical products and sectors identified by the administration will continue to expand. This will be complemented by legislation and/or meaningful government policy to increase US self-reliance in these areas.

Most significantly, the emerging and most keenly contested and disruptive battleground will be in enabling technologies neatly captured in Beijing’s ‘Made in China 2025’ blueprint. The United States will want to ensure China is not in a position to dominate key technologies and assume the box seat to control supply and value chains for these emerging and enabling technologies and sectors.

It is in this context that China’s relative weaknesses are poorly appreciated and its relative strengths often over-estimated by many Australian commentators. In fact, the United States is realising it has some powerful and possibly decisive tools to use and economic cards with which to play. Moreover, the willingness and resolve to use these are growing.

In particular, the United States will deploy a mix of trade, legislative, regulatory, financial and restrictive people-to-people policies to enhance its own advantages in these areas (and occasionally those of its allies and like-minded countries).

Conversely, and with respect to these technologies and sectors, the United States will increasingly consider tougher measures which will be designed to:

- Restrict China’s access to the large and advanced markets it needs

- Limit and retard China’s capacity to accelerate innovation

- Control channels for China to develop and/or acquire technology and know-how.

The general approach will be to deny, restrict or disrupt Chinese access to capital, markets and know-how. The greater the impact of the technology or commercial activity on national power and capability, the more the related supply and value chains will be contested and protected — the more disruption and difficult decisions will be thrust onto advanced trading nations such as Australia.

Introduction

The hope of a world where economic entities and individuals freely compete on a level playing field with a diminishing role for government is fading. The year 2019 witnessed an escalation of economic tensions between the United States and China with a temporary and fragile truce following the conclusion of a Phase One Trade Deal between the two countries.

A previous report by this author, which was co-published by the United States Studies Centre, argued the United States would seek to disentangle supply chains in key technologies and strategic sectors away from China while the definition of these technologies and strategic sectors will only grow. Moreover, there would be more US attempts to capture a greater share of the value chain across a growing number of sectors and deny it to China.1

At a time when the United States is facing unprecedented challenges from the COVID-19 pandemic, these sentiments have increased in breadth and depth — not just with respect to the administration, Congress and both major political parties, but amongst the business community and population. Significantly, a Joe Biden administration will move in different directions in some areas but emphasis on the comprehensive challenge posed by China will remain.2 There is palpable, growing and warranted anger in the United States and around the world3 directed towards the Chinese Communist Party. President Donald Trump is factually correct that COVID-19 “could have been stopped right where it came from, China” and that “the world is paying a very big price.”4 The broadly accepted and documented timeline of events support this conclusion.5

The devastating and ongoing effects of COVID-19 is strengthening resolve in the United States to consider ways to entrench ‘economic distance’ from China.6 There is growing discussion about decoupling, disentangling and diversification away from China7 to ensure a more self-reliant and resilient United States that is less dependent on the decisions of the Communist Party.8 Although not inherently precise terms, these ‘D’ words are often used interchangeably and cause confusion. This report adheres to the following distinctions:

- Decoupling implies a full split from China in the supply/value chain or sector.

- Disentangling implies loosening or unravelling the China-based element of the supply/value chain. This might be a precursor to decoupling or might merely be a precautionary risk management approach.

- Diversification implies a risk management or hedging approach of guarding against over-reliance on China through developing supply/value chains elsewhere. It is not necessarily a precursor to decoupling or disentangling.

Additionally:

- Supply chain refers to the steps or sequence of processes involved in the production or distribution of a product or service.

- Value chain refers to the process or activities by which value is added. This includes the production, marketing and provision of related services.

There are some who dismiss the prospect of US-China distancing and others who argue it is needed sooner rather than later. This report looks at what US economic decoupling, disentangling and diversifying from China might look like, a trend and mindset which will accelerate during and after the COVID-19 pandemic. It suggests what is feasible, probable and unlikely when it comes to an economic separation between the two countries.

‘Made in China’ will still be ubiquitous with respect to many common products, but the days of ‘Trust in Beijing’ are quickly passing.

The report argues that ‘Made in China’ will be difficult or impossible to shift in the producing of many traditional and current generation merchandise products. But the list of strategic or critical products and sectors will expand, and this will be complemented by legislation and government policy to increase US self-reliance in this context. There will also be greater efforts by the US government and firms to capture more of the value in global production processes. Importantly, the emerging and most disruptive battleground will be in the enabling technology sectors neatly captured in Beijing’s ‘Made in China 2025’ blueprint.

When the pandemic eventually passes, ‘normal’ functioning of the global economy will not be like it was before. ‘Made in China’ will still be ubiquitous with respect to many common products, but the days of ‘Trust in Beijing’ are quickly passing.

The reasons for decoupling, disentangling and diversifying away from China

The ongoing frictions over 5G networks and the exclusion of Huawei from the rollout of that technology in the United States and other countries, such as Australia, is the pointy end of distancing from China. The 5G issue raises all salient points of contention:

- The differences between the political economies of China and liberal democratic nations;

- The relationship between public and private Chinese firms on the one hand and the Communist Party on the other, and the capacity of the latter to force the former to do its bidding;

- Beijing’s use of subsidies, tax breaks, domestic regulation to disadvantage foreign firms and ensure the dominance of its chosen champions;

- Forced transfers of intellectual property and even theft to benefit preferred Chinese firms, etc.9

In policy terms, and given the well-known strategic implications at stake, the Huawei decision was a relatively clear-cut one for the United States (and Australia) to make.

The 5G question aside, the terms of partial American economic separation from China is a far more complex and fraught challenge than the relatively clear-cut battlelines surrounding the rollout of 5G. The ongoing US-China trade war already provided the setting for discussion and debate about the three Ds. The devastation of the COVID-19 pandemic will only accelerate and intensify this conversation.

We also encounter new complexities. From January to March, the problem was the global disruption to supply chains caused by a Chinese shutdown at a time when the American economy was growing and its demand for goods and services was high. Since March, the problem is that a gradually awakening Chinese economy is occurring when the United States and much of the world has shut down.

Since March, the problem is that a gradually awakening Chinese economy is occurring when America and much of the world has shut down.

For a Chinese economy already enduring excess capacity problems and which depends heavily on external demand, the next few months will prove challenging. For the United States, dealing with COVID-19 has been a lesson to the government and the broader population of the vulnerabilities of relying on foreign supply chains to supply essential goods, especially in times of crises and when those supply chains are based in China.10 For example, the United States is dependent on mainly Chinese suppliers for face masks, gloves and protective gowns.11 The United States depend on Chinese firms for more than 90 per cent of antibiotics, vitamin C, ibuprofen and hydrocortisone, as well as 70 per cent of acetaminophen and about 45 per cent of heparin.12 Although many parts for ventilators are made in the United States, the production of these life-prolonging machines is largely done in China. With the shutting down of the economy occurring in the United States, Chinese factories are having problems sourcing these parts to make the ventilators to ship back to the United States.13

For governments and policymakers, reliance on supply chains based in China for strategic or critical products and services leaves the United States vulnerable to coercion and blackmail while potentially rendering it overly vulnerable or helpless in various circumstances. In recent times, the administration has identified dramatically lowering reliance on China for critical minerals such as lithium, cobalt and a group of minerals known commonly as rare earths which are required for electric vehicles, green technologies, sophisticated consumer products such as smartphones, and other military applications such as lasers.

One can expect to see more initiatives such as the Energy Resource Governance Initiative14 between Australia, Botswana, Peru and the United States to promote diversification away from reliance on Chinese rare earths and rules to govern the supply and sale of strategic commodities.15

The pandemic has also created a new battleground in the form of a renewed push from within the White House to create powerful incentives for US-based firms to produce pharmaceutical and medical supplies domestically through mandating US government entities to buy such supplies from domestic sources.16

The so-called ‘Buy America’ draft executive order being pushed by Peter Navarro, the White House’s Director of Trade and Manufacturing Policy, might well be watered-down or rejected by Trump given trenchant opposition by many pharmaceutical companies. But the ground has shifted significantly and will continue to move away from unrestrained globalisation of supply chains.

Where previous voices such as Navarro’s were seen as being at the fringes of the ‘hawkish’ and ‘nationalistic’ end of the economic spectrum, there is a growing appreciation that the low-inventory, just-in-time approach of firms in critical and strategic sectors is ill-suited to an environment where geopolitical rivalries and black swan (or grey rhino) risk events are real. The notion firms necessarily operate with a ‘social licence’ will grow in currency and the maximisation of profits using the most cost-efficient way to source parts, components and expertise will no longer be seen to be axiomatically in the national interest.

A new mindset for many sectors is emerging: the more direct control one has over supply chains, and the more straightforward the sourcing of parts, components and expertise, the better and safer it is for the United States.

Moreover, it is almost certain the definition and range of what constitutes a strategic or critical sector as defined by the administration and strategic experts will expand. It is also likely they will want an ever-larger percentage of domestically sourced parts, components and expertise — by quantity and/or value — in these sectors to come from domestic or reliable sources in friendly and like-minded countries. The bottom line is a new mindset for many sectors is emerging: the more direct control one has over supply chains, and the more straightforward the sourcing of parts, components and expertise, the better and safer it is for the United States.

While many in the business community are inherently uncomfortable with a legislated ‘Buy America’ framework or the idea of decoupling or disentangling global supply chains which they have invested heavily in, there is a growing appreciation that reducing costs through low inventory and global sourcing brings with it risks that were not taken seriously just weeks ago.

Consequently, many American firms will likely change tack from dismissing any challenge to ‘globalisation as normal’ toward resisting an open-ended and ever-expanding definition of critical or strategic sectors which will tempt those not concerned about the costs or operational difficulty of upending existing supply chains.

Many firms will also want to prevent onerous legislation mandating them to source parts, components and expertise domestically. Instead, they will seek the commercial and operational flexibility to meet agreed prudential targets and standards in accordance with evolving government policy. This exact dynamic is playing out with respect to the proposed ‘Buy America’ executive order to designate medical and pharmaceutical equipment as ‘critical technologies’ under the 1950 Defense Protection Act.17

China’s current role in global supply and value chains

As fraught as the above issues of immediate importance in the current environment might be, decoupling, disentangling and diversifying away from China is much more than just identifying particular sectors or products deemed critical or strategic in an ad hoc manner. The United States is cobbling together a framework to compete against what the administration has termed a ‘comprehensive’ Chinese competitor. A genuine economic divorce is not plausible while not every supply or value chain can, or ought to be, decoupled or disentangled from China. These actions, and diversification away from China, need to be feasible for the American private sector.

The key is to understand what is possible and likely, and what is not feasible or too costly to consider. This needs a deeper understanding of China’s place in the global economy.

The fact that about two-thirds of countries trade more with China than the United States18 seems to be further affirmation the former has long surpassed the latter as the pre-eminent economic power.

Australians tend to have an outsized view of China’s role given it is our largest trading partner by some distance and the major source of external demand for Australian mineral and energy commodities, basic and processed agricultural products, and services such as education and tourism. Macro statistics also indicate China’s economic importance to the world given it is now the top merchandise trading country and the top trading partner for around 130 countries in the world. The fact that about two-thirds of countries trade more with China than the United States18 seems to be further affirmation the former has long surpassed the latter as the pre-eminent economic power. It is no wonder many Australian commentators are sceptical about the notion of the United States decoupling or disentangling from China.19

This section looks broadly at China’s evolving role in regional and global supply and value chains. It is a mixed story: dominant in some areas and not so in others. Some aspects of decoupling, disentangling and/or diversification vis-à-vis China will be feasible and desirable for the United States while it will not be possible or desirable in other cases. This will help one gain a better understanding of what decoupling, disentangling and diversification might look like in a post-COVID-19 world.

a. Traditional and current generation merchandise goods

Since the Second World War, rapidly developing East Asian economies such as Japan, South Korea, Taiwan, Singapore, Malaysia, Thailand, and, most recently, China and Vietnam, have all relied upon a remarkably similar export-manufacturing model. They seek to grow and upscale their economies by serving export markets through the production of parts, assembling finished products and developing export services to support the export sector. In short, it is about making products more cheaply, quickly, and reliably than other countries.

This remains integral to East Asia’s rise. East Asian manufacturing trade as a proportion of global manufacturing trade has increased from about 12 per cent in 1970 to 26 per cent in 1990 to more than 35 per cent today.20 The share of global export manufacturing of the Association of Southeast Asian Nations (ASEAN) region increased from a miniscule 0.3 per cent in 1970 to about 6 per cent currently. In 1990, at the peak of Japan’s economic rise, its share of global export manufacturing exceeded 12 per cent. China has become the outstanding individual performer, increasing its share of global export manufacturing from 0.5 per cent in 1970 to about 13.5 per cent currently.

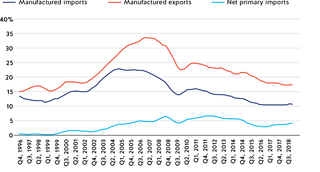

Figure 1. Chinese trade as a percentage share of GDP

For China, the importance of the export-driven growth model reached its peak in around 2007-2008 (see Figure 1). Merchandise trade as a share of GDP is falling, even though in absolute terms, trade and services and trade volumes are still rising, albeit slowly. From a GDP growth perspective, net exports are no longer a significant contributor, as they were in the mid-2000s.

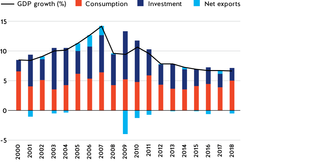

Figure 2. Components of Chinese GDP growth, 2000–18

Four contemporary developments are significant.

First, East Asia (comprising China, Japan, South Korea and the ASEAN and Taiwanese economies) has become the most integrated region in the world when it comes to the production of most merchandise products. It is now the norm that products comprising of several steps before final assembly are produced in two or more regional countries.21 It is estimated around two-thirds of global trade is in intermediate rather than finished goods.22 Moreover, almost a quarter of value-added to traded goods in the world is from East Asia, which is more than any other part of the world, and this figure continues to grow.23

Second, China has replaced Japan, South Korea and Taiwan as the central hub of these integrated supply chains. This is reflected in China’s share of global exports in highly integrated sectors such as information and communications technology (ICT), computer, electronic and optical products, electrical equipment, machinery and parts.24 These are relatively ‘high-tech’ sectors where China’s trade surplus in these sectors has grown significantly from a decade ago.25 For example, in terms of global market share for ICT exports, China has captured about one-third of the entire market. South Korea is next with around eight per cent.26

China’s huge footprint in global exports is reflected in the estimate it accounts for about 35 per cent of global manufacturing but only ten per cent of global household consumption.

Similar trends are observed in so-called mid-tech sectors such as metals, plastics and glass, and low-tech export sectors such as textiles and apparel, footwear and furniture. China has a net export surplus in most of these sectors. China’s huge footprint in global exports is reflected in the estimate it accounts for about 35 per cent of global manufacturing but only ten per cent of global household consumption.27

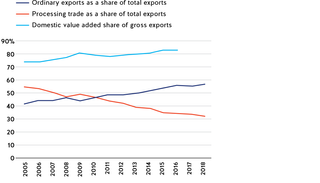

Third, while China’s share of processing (intermediate parts) trade of exports is falling, the relative declines in regional and global share are generally in the mid-tech and low-tech sectors. In the high-tech and higher value-added sectors, the domestic value-added component of China’s exports is increasing. This means China is transitioning away from being a low-cost assembler of exported products towards adding more value in less sophisticated sectors and becoming an increasingly dominant player in more sophisticated sectors. It is also a result of there being greater vertical integration within China for these sectors in the production process: from the procurement of materials and components to research and development (R&D), intermediate manufacturing of parts and assembly, to related services such as sales and marketing before sold to an external consumer.

Figure 3 shows the components of Chinese exports, broken down by ordinary exports (finished goods) and processing exports (intermediate parts of an unfinished good), as a percentage of total trade, along with the domestic value-added of exports, from 2005 to 2018. It represents not just the growth of ‘Made in China’ — which reflects the location of final assembly — but the more impactful rise of ‘Value added in China’.

Figure 3. Domestic value added in Chinese exports and type of traded good

Fourth, China’s emergence as the centre of the vast intra-regional production zone is far ahead of levels of Chinese foreign direct investment (FDI) in manufacturing and services in the same East Asian region. This suggests either many countries are reluctant to allow too much Chinese FDI into these sectors of their economy, Chinese firms are more interested in continually shifting supply and value chains to China than they are in owning such assets regionally, or a combination of both.

For example, in 2017-2018, Chinese FDI into the ASEAN economies was about half of Japan’s. When it comes to FDI into ASEAN manufacturing sectors, the United States (US$12 billion), Japan (US$10 billion), intra-ASEAN (US$8 billion) and the European Union (US$7 billion) were the largest sources.28 Chinese FDI was largely devoted to textbook Belt and Road Initiative investments in infrastructure, construction and energy and more focused on the poorer and less integrated economies of Cambodia, Laos and Myanmar. There are also surprisingly low levels of Chinese FDI in Japan and South Korea. The situation is even more pronounced in the United States where Chinese FDI accounts for a small proportion of overall FDI. The figure was just less than US$40 billion in 2018 which ranked China as only the 15th-most important source.29

The bottom line is while these countries depend heavily on China for parts and products, they are far more reliant on capital and know-how from industrialised economies and each other to upscale than they are on China or Chinese firms.

b. Next-generation technologies and sectors

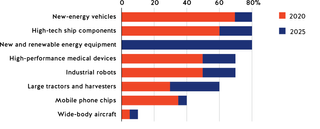

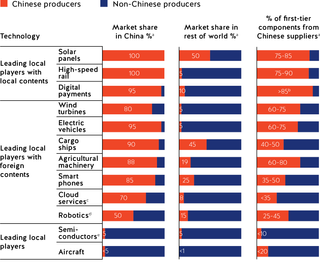

In May 2015, the Chinese State Council launched ‘Made in China 2025’ (MIC 2025) to guide the upgrading of Chinese industry, production, and innovation over the next ten years. The blueprint identified the sectors shown in Figure 4 as essential.

Figure 4. Sectors targeted by ‘Made in China 2025’

MIC 2025 pursues the same central planning and target-setting approach in seeking to implement an industrial policy which improves capital allocation, policy coordination, and innovation throughout the entire political economy and in accordance with strategic objectives. The MIC 2025 blueprint is also largely driven by China’s desire to avoid the so-called middle-income trap. This occurs when rising but still developing economies lose their competitive advantage due to factors such as rising wages, a declining supply of cheap labour, and less favourable demographics, and are unable to compete with more innovative and productive advanced economies.

However, MIC 2025 is far more extensive and significant for several important reasons.

First, the program seeks control over, and dominance of, entire manufacturing processes, supply chains, and associated services for the sectors identified in the MIC 2025 plan. For example, it specifies targets for the domestic content of core components and materials: 40 per cent by 2020 and 70 per cent by 2025 (a violation of World Trade Organization rules). It makes explicit reference to how much of China’s technology markets in various sectors should be controlled by Chinese companies and how many component parts in various relevant products need to be made in China. It sets out industry-specific and tech-specific targets in detail. These include domestic market share targets for Chinese technology, quotas for smart machinery use, targets for the number of patents per RMB 100 million in revenue, and details about the development of world-class brands in these selected industries.

Figure 5. Chinese companies’ domestic market-share target for ‘Made in China 2025’ sectors

Moreover, while the state and state-controlled sectors will still lead, MIC 2025 will co-opt and use indigenous private firms to ensure value creation is created in and retained within China. All state-controlled and private indigenous firms are potential partners and participants in MIC 2025, and those advancing the blueprint’s objectives will be offered financial, commercial, regulatory, legal, and political support and assistance.

Additionally, MIC 2025 reads like a comprehensive blueprint for domestic reform to “upgrade” the entire Chinese economy. For example, its stated goals are linked and one follows from the other:

- Improving manufacturing innovation;

- Integrating information technology and industry;

- Bolstering the industrial base;

- Fostering world-class Chinese brands;

- Enforcing green technologies;

- Promoting breakthroughs in ten key sectors;

- Restructuring the country’s entire manufacturing base;

- Promoting service-oriented manufacturing; and

- Having Chinese firms globalise manufacturing.

Performance indicators are extensive and taken seriously.30

In this sense, it is a whole-of-government and whole-of-economy plan intended not just to reform and enhance China’s capabilities in these vital sectors, but to hit defined benchmarks indicating ultimate success. It is an elaborate blueprint to update “capitalism with Chinese characteristics” for the first half of this century.

Finally, MIC 2025 is much more ambitious and muscular in its outward-focused end goals than previous blueprints. Its objective is not simply to ensure China becomes an advanced and competitive economy. The internal measures are explicitly designed to create the foundation for Chinese firms to dominate these sectors in global markets. China is also to become a global hub for firms in these sectors. This will allow its economy to host, absorb, and localise entire supply chains, intellectual property, and related services.

How is China doing?

With respect to the current state of play in key technologies, China’s progress is mixed and is not dominant across the board, as much common reporting might suggest. This is true for several reasons.

China is not yet the standard-setter for high-tech and emerging industries. For example, one comprehensive analysis of more than 80 technologies in 11 categories found more than 90 per cent of technologies used in China adhered to global standards, which were largely shaped by advanced economy firms and governments.31 This reflects the practical reality that global leaders and the governments they are headquartered in tend to set global standards. Indeed, MIC 2025 and other Chinese blueprints were adopted to reverse this situation of global standards being set by other countries.

In addition, supply chains for relatively lower-tech tradeable goods are becoming more regional, which accounts for much of the increase in trade between China and the ASEAN countries. In contrast, supply chains for high-tech products are becoming more global, and China is seeking to dominate them through greater horizontal and vertical integration. Examples of Chinese success would be solar panels, wind turbines and agricultural machinery.

With respect to high-tech supply chains where much future value will reside, Beijing is far from self-reliant. In areas such as robotics, aeronautics, semiconductors, closed-circuit chips and cloud services, China has low domestic and/or global market share and is heavily dependent on external sources.

One of the most acute cases for China is semiconductors which are integral to almost all aspects of the MIC 2025 plan and, more generally, for China’s capacity to move up the value chain and compete into the future. In 2018, China imported more than US$312 billion worth of semiconductors from American, Japanese, South Korean and Dutch firms. This is 30 per cent more than the value of Chinese imports of oil in the same year.32 This Chinese vulnerability led the Trump administration to place restrictions on the sale of chips to Huawei (which is on a banned ‘entity list’).33 At the time of writing this report, the administration is considering further measures to require foreign companies using US chip-making equipment to obtain a US licence before supplying chips to Chinese firms such as Huawei.34 This is an attempt to stop firms in countries such as Taiwan from selling chips to China using American equipment and know-how.

Figure 6. Chinese share of production in key sectors and reliance on global sources and supply chains, 2018

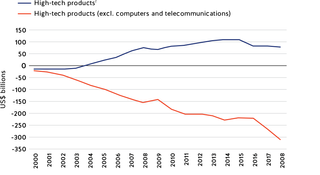

One can show China’s reliance on import of high-tech components, machinery, know-how, and intellectual property in other ways. Using China’s National Bureau of Statistics definition of “high-tech,” which correlates closely with MIC 2025 sectors, China has a trade deficit once computers and telecommunications equipment (which are current generation technologies) are excluded.35 The other high-tech sectors include biotechnology and life-sciences, opto-electronics, electronics, computer-integrated machinery, and aerospace materials and applications.36

Figure 7. China’s trade balance in high-tech components

China’s reliance on foreign technology and know-how is also reflected in China’s net deficit in intellectual property (IP) charges which means it pays more for the authorised use of IP than it receives in IP charges. In 2017, China received US$5 billion in IP charges and paid US$29 billion. The corresponding ratios for other advanced economies such as the United States, Japan, Germany and South Korea (in US$ billions) was 128:51, 42:21, 20:13 and 7:9, respectively.37

These Chinese vulnerabilities and dependencies will be the major theatre for economic distancing between the two countries.

Obstacles to achieving the three Ds

The ongoing US-China economic tensions and the blunt rhetoric accompanying it has forced some change in terms of supply chain movement. Many multinational firms continue to explore supply-chain options outside China,38 a trend which was already occurring due to normal economic considerations. This includes rapid increases in average manufacturing wages in China which are predicted to be double in 2025 what they were in 2015.39

Other policy specific measures have enjoyed only modest success. The 2017 reduction in US corporate tax rates to encourage American multi-nationals to bring offshore accumulated profits back to the United States is one case in point. While there were reductions in overseas cash holdings and about US$500 billion was brought back into the United States in 2018 alone, much of this was used for stock buy-backs and to increase dividend payout rather than invest in new supply chains or chain links in the United States.40

Many multinational firms continue to explore supply-chain options outside China, a trend which was already occurring due to normal economic considerations.

To be sure, discussion of disentangling or diversifying supply chains away from China will continue to take place in board rooms given the likely continuation of economic tensions and greater wariness of Chinese institutions and governance approaches in the aftermath of COVID-19.41

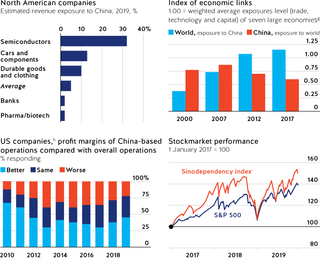

However, there is considerable evidence many foreign firms have already baked-in considerations of political, institutional, legal and regulatory risks. Even at the height of economic tensions, global FDI into China continued to increase by around 3 per cent annually which is comparable to annual increases for the past five years.42 A member survey in late 2019 of American businesses in China revealed 87 per cent had not relocated supply chains away from China and had no immediate plans to do so.43

In short, a growing trickle of firms leaving will not become a flood unless credible allegations COVID-19 continues to be much more widespread in China than the Communist Party is found to be true and the virus runs rampant throughout the whole country.44

1. Stickiness and inertia — reasons why supply chains will not flee China

One reason why multi-national firms choose to invest in Chinese-based supply chains is that doing so is mandatory if one seeks to gain access to its large and growing domestic market. This reason is still very relevant. For example, Caterpillar has more than 30 plants in China as the country is the source of up to 10 per cent of its overall sales revenue.45 All Caterpillar equipment made in China is sold in the country.

As multiple surveys show, such as the one by the US-China Business Council, more than three-quarters of US firms say they are doing better or as well in China compared to their overall operations globally (see Figure 8).

Figure 8. Exposure to China

Furthermore, the cost of relocating supply chains out of China can be prohibitive, and in some instances, impractical. The example of Taiwanese firm Foxconn which makes iPhones is instructive. Foxconn is reliant on China’s excellent manufacturing and transport infrastructure and draws on a network of more than 1,500 Chinese suppliers. In 2018, the company produced around 220 million smartphones in the country to sell to the world.46 Other prospective production centres such as Vietnam and India are not comparable substitutes in the foreseeable future. Indeed, it is estimated there are 51,000 international companies with one or more direct suppliers from Wuhan (now inextricably linked with COVID-19) while more than five million companies — and 938 Fortune 1000 companies — have one or more tier-two suppliers in the region.47

One should also bear in mind in the short-term, and possibly longer, the effects of COVID-19 in alternative manufacturing centres such as Vietnam, Thailand, Bangladesh and India are uncertain. If China can manage and contain infections in key manufacturing provinces, it might be far too risky for firms to shift operations out of China into economies still battling COVID-19.

It is estimated there are 51,000 international companies with one or more direct suppliers from Wuhan while more than five million companies — and 938 Fortune 1000 companies — have one or more tier-two suppliers in the region.

Third, the unintended consequences of sudden movements of supply chains within an integrated region are considerable. One extensive study, which is reflective of many performed since the US-China economic tensions shows that Taiwan, South Korea and Malaysia would suffer significantly from meaningful declines in China’s exports to the United States. These countries are inextricably attached to regional export-manufacturing supply chains centred in China. About 1.6 per cent, 0.8 per cent and 0.7 per cent of their respective GDP is directly tied to Chinese exports to the United States.48

This is particularly relevant to the computer/electronics/electrical (EEE) export-manufacturing sector which accounts for 20-50 per cent of the total value of exports for the ASEAN economies, Japan and South Korea. The EEE sectors in Taiwan, South Korea, Malaysia, Singapore, Thailand and the Philippines are heavily dependent on being part of a supply chain which ends with the final assembly of the product in China before being exported to the US consumer.49

Fourth, forcing China out of the supply chain through deny and disrupt approaches can inflict considerable self-harm. The semiconductor issue is instructive. If the United States completely banned sales of semiconductors to China, this would pose an existential threat to Huawei and, in the short to medium-term severely degrade Huawei’s capacity to conduct its business in China and external markets. However, a complete ban on semiconductor sales to China could mean American firms lose about 18 per cent of their global share and about 37 per cent of existing revenues.50 The US semiconductor industry argues this will allow South Korea to eventually overtake the United States as the global leader in semiconductors.

Meanwhile, US firms would have to cut R&D and other capital expenditures, which would impact their global leadership of this sector. Bear in mind that over the past decade, the US semiconductor industry has spent more than US$312 billion on R&D with US$39 billion in 2018 alone. This is double the total amount spent on R&D by international competitors and is largely possible because of the United States’s 50 per cent global market share — with 35 per cent of this global share coming from the Chinese market.51

2. Multiple production regions for multiple consumer markets

When it comes to traditional and current generation merchandise goods, the current and future administrations will find it difficult to force American firms to relocate supply chains back to the United States when goods are being produced for markets in Asia and elsewhere outside North America. The trend of supply and value chains for traditional and current-generation merchandise goods becoming more regional will continue. This is helped by the rapid pace of technological progress in manufacturing-related technologies such as robotics, automation, artificial intelligence and 3D printing — along with these technologies interacting with each other in ever more sophisticated ways.52 These technologies increase incentives to locate production and assembly of merchandise goods closer to the end consumer.

However, the flip side is the declining importance of direct labour inputs and even land costs resulting from these technological developments mean it is far more feasible to locate supply and value chains in the United States when producing products for US consumers. The value and impact of investment in such technologies is already proven. For example, more than one-third of global installations of robots are in China. Japan and South Korea fill out the top three.53 These are the countries which are dominating other regional manufacturing economies as it is where the most advanced regional manufacturing plants are based. The best and most advanced industrial robotic companies are headquartered in the United States, Japan and Europe. Yet, the United States is only the fourth-largest robot installer in the world and seventh when it comes to robot density (per 10,000 workers).54

More than one-third of global installations of robots are in China. Japan and South Korea fill out the top three.

While it does not make sense for the United States to compete for low-paid global manufacturing jobs (and will fail if it tries to do so,) the emphasis will be increasingly on encouraging advanced manufacturing plants serving American consumers to be based in the United States — by far the world’s largest domestic consumption market. This will create more highly-paid and skilled jobs in manufacturing services, logistics, marketing, etc., where much of the value will reside and be created.55

These issues are already on the radar of the current administration56 and the previous one.57 But there will be an acceleration of specific US industrial policies to create more incentives for American firms and those from advanced liked-minded entities such as Japan, South Korea, the European Union (EU) and Australia to invest in these technologies and capabilities within the United States rather than in China.

The result could be an emerging North American production and assembly zone for an increasing number of merchandise goods designed and dedicated to serving North American consumer markets.

The emerging battleground: weakening foundations for future Chinese tech-success

Competition between two large powers does not preclude cooperation on many issues but is nevertheless disconcerting. Such powers tend to focus on relative, rather than absolute gains, meaning progress by one side comes at the expense of the other. This might appear an inferior mindset in a globalised world until one considers Beijing has long held this mindset concerning the United States from when it entered the modern global trading system.58

Productivity improvements and value creation with advanced robots and automation increases exponentially when it is integrated with advances in fields such as artificial intelligence, cloud computing, big data and advanced materials. Semiconductors, quantum applications and nanotechnology can also be added onto the list. These enabling technologies not only drive enormous leaps and enhancements across sectors but create entirely new high-valued industries (offering highly-paid jobs) which have nothing to do with advanced manufacturing. Clearly, they also have enormous societal, strategic and military implications.

Given prevention is better than finding a cure, the United States will want to ensure China is not in the position to dominate key technologies and assume the box seat to control supply and value chains for these emerging and enabling technologies and sectors.

It is for these reasons China is determined to achieve its MIC 2025 goals which explicitly includes controlling supply and value chains in these industries and denying the benefits of these for other countries. This is regardless of whether Beijing perseveres with the moniker ‘Made in China 2025’ or not. It is also for these reasons achieving US industrial leadership in these technologies, and denying leadership to China, is paramount in what is still an emerging battleground.

When it comes to economic distancing in the context of supply and value chains, the sectors outlined in MIC 2025 are where the United State will compete most earnestly, intensely, and with preparedness to create the most disruption even if there are collateral impacts on allies and friends. Given prevention is better than finding a cure, the United States will want to ensure China is not in the position to dominate key technologies and assume the box seat to control supply and value chains for these emerging and enabling technologies and sectors.

Leadership and dominance in these technologies and sectors are generally predicated on four conditions:

- Investment at scale.

- Access to large and advanced markets.

- An effective system to drive innovation and competition.

- Channels to develop and/or acquire technology and know-how.

China’s state-led approach and economic size clearly fulfil the first condition. However, meeting the other three conditions are far more problematic for China.

One common, but incorrect, assumption is China has a sufficiently large and innovative domestic market (condition 2 above) to provide the foundation for success in any emerging sector and does not need other markets such as the United States. Many point to the rollout of its 5G network and progress in artificial intelligence and big data which complements many 5G applications.

However, it becomes much more challenging if China’s access to markets in North America and Europe is becoming more restricted — as it is — or if its firms are denied access to essential inputs such as big data from those markets. Australia’s lead to ban Huawei from the rollout of the country’s 5G network and the possibility other advanced economies will follow would be an enormous blow to Beijing’s plans. Chinese firms need to be commercially active in advanced economies in the earlier stages of the emergence of these advanced sectors. If they are not, it will be extremely difficult for them to enter markets already dominated by competitive, advanced economy firms at a later stage.

For example, accessing and utilising big data required from those markets would be commercially and technically difficult, even if there were no ban on Chinese firms. For most MIC 2025 categories, lack of access to these large foreign markets will impede the development of local Chinese clusters — a concentration of locally connected businesses, suppliers and associated institutions — in those sectors, and simply dominating the Chinese market will not suffice. Beijing needs the first-mover advantage in foreign markets if it is to develop a new export-oriented market, as MIC 2025 and other blueprints such as the Thirteenth Five Year Plan for Science and Technology, the Thirteenth Five Year Plan for National Informatization, and the National Cybersecurity Strategy envisage.

Moreover, while China has narrowed the R&D spend gap with the United States (US$254 billion by China compared to US$564 billion by the United States),59 around 80 per cent of China’s R&D system is geared toward using acquired knowledge and innovation to produce or improve products and services. In China, fewer resources go toward basic or applied research than in other advanced economies. This is reflected in a surprising finding that Chinese universities contributed on average less than ten per cent of Chinese R&D activity between 1991 and 2016 which is much lower than countries such as the United States and Japan. There are poor links between Chinese universities and businesses, with one report suggesting only 2.6 per cent of research articles were collaborations between universities and industry in the same period.60

Reports indicate Chinese regulatory hurdles favouring state-controlled companies and private ‘national champions’, the crowding out of the private sector, and insufficient IP protections continue to adversely affect creativity and basic innovation in the Chinese political economy.

The point is China’s system to accelerate creativity and basic innovation is deficient regarding other advanced economies, such as those in North America, Europe, and Japan. Its impressive advances in high-speed rail, quantum and high-speed computing, information and communications technology (ICT), AI, electric vehicles, solar panels, and space, have been on the back of technologies and know-how acquired, adapted or stolen from advanced economies. Advances driven by graduate students in these fields depend on their continued access to foreign universities and academics. Reports indicate Chinese regulatory hurdles favouring state-controlled companies and private ‘national champions’, the crowding out of the private sector, and insufficient IP protections continue to adversely affect creativity and basic innovation in the Chinese political economy.61

Since China is over-reliant on the acquisition and adaptation of basic and applied research from external sources (and forced transfers or IP theft), it pours resources into building a presence in these sectors, blocks foreign competitors from entering these markets domestically (except through joint-ventures), captures and vertically integrates supply chains for associated products and applications, and funds the “going out” strategies of its domestic firms in order to under-price foreign competitors before eventually dominating these markets globally. This was the model Beijing pursued in becoming a dominant supplier of solar and LCD panels to the world.

In this context, below are some options and directions which will be seriously considered by the United States to exploit advantages and exacerbate Chinese weaknesses.

The general approach will be to deny or restrict Chinese access to capital, markets and know-how. This is what China needs to meet the three conditions where it is weakest and most vulnerable: access to large and advanced markets; development of an effective system to drive innovation and competition; and realise channels to develop and/or acquire technology and know-how.

For the United States, demanding reciprocity will be used as both a sword and shield in diplomatic and tactical terms.

The lack of reciprocity between what China offers the United States (and other advanced economies) and vice versa is so stark and such an entrenched feature of the Chinese political economy that the demand for genuine reciprocity will most likely never be met. But demanding reciprocity will put China on the back foot and help the United States dictate the pace and nature of bilateral or mini-lateral negotiations given long-standing failures by the World Trade Organization to resolve many of these issues.62

Nor is the demand for reciprocity simply a negotiating tool. In sectors and areas that are purely economic rather than genuinely strategic, US companies should be able to sell as freely in China as the Chinese are able to do in the United States. Likewise, in non-sensitive areas, American firms should be able to invest as freely in China and with the same protections as China is able to do in the United States.

However, in sensitive sectors such as enabling technology, reciprocal treatment and protection of rights include measures which would entail deep reforms to China’s economic and legal institutions and practices, without which reciprocity would be impossible. As Beijing will be unlikely or unable to offer acceptable ground on such reforms or do so in a timely manner, the United States needs to justify to China (and to domestic stakeholders) why many Chinese purchases of US technology companies ought to be blocked, and to do so in a way which provides more than ambiguous explanations the two countries are engaged in a strategic and technological competition or rivalry.

Bear in mind the United States needs time to organise its legal and regulatory response and must, therefore, be able to dictate the pace of negotiations with China. The Committee on Foreign Investment in the United States (CFIUS) is necessarily a flexible and adaptable regime, which must consider changing realities and new challenges to the national interest. It will take some time for CFIUS to develop effective frameworks for China and for supporting legislation, such as the 2018 Foreign Investment Risk Review Modernization Act (FIRRMA) — which came into effect in February 2020 — and reforms to the Export Control Act, to be considered and passed.63

A tit-for-tat restriction by one against the other suits the United States because cooperation has become far more beneficial to Beijing than to Washington.

Moreover, it will also take some time for the United States (and other key allies and partners) to coordinate legislative and policy responses involving scrutinising and potentially blocking Chinese purchases of technology assets. In this case, FIRRMA has recommended CFIUS establish a process for exchanging information with allies and partners to help coordinate action with respect to foreign direct investment policy which poses national security risks, especially in the technology sectors.64

The principle of “reciprocity” will also be used to prevent or limit unintended or illegitimate technological leakage from the United States to China. For example, the legislative and regulatory frameworks for FDI will increasingly only consider allowing Chinese investment in sensitive sectors if those sectors in China are open to foreign investors. Since virtually all these sensitive sectors in China are closed or restricted, this gives the United States a strong reason to knock back any Chinese investment which might prove problematic. Science and technology cooperation with China should be reciprocal. A tit-for-tat restriction by one against the other suits the United States because cooperation has become far more beneficial to Beijing than to Washington. In this context, documents such as the US-China Agreement on Cooperation in Science and Technology might well be rewritten to reflect the principle of reciprocity.

Selective disentangling or decoupling in the strategic tech sectors may look like one of the following four scenarios.

1. Restricting Chinese access to capital

Florida Senator Marco Rubio is just one leading voice advocating for stronger scrutiny and restraints for Chinese companies to be included in stock indices (e.g. MSCI All Country World ex-US Investable Market Index) and pension funds (e.g. Thrift Savings Plan’s International Stock Fund).65 Being included in such indices and funds provide Chinese firms with flow-on advantages such as access to cheaper capital and captured institutional investors given the need for benchmark or passive funds to own these stocks.66 Critically, the Chinese firms included are largely state-owned-enterprises and ‘national champions’ which are central to Beijing’s MIC 2025 plan.

There are growing calls from within the administration and members of Congress to tighten up the rules which allow Chinese firms such as Alibaba (market cap of approximately US$500 billion) to list on US exchanges.67 There are currently about 160 Chinese firms listed with a combined market value of more than US$1 trillion. This is a significant presence. Shares on the Shanghai Stock Exchange which is China’s largest exchange have a total market capitalisation of about US$4 trillion.

The regulatory argument is Chinese firms gain access to US capital through listing but the Public Company Accounting Oversight Board, which oversees the audit of public companies, has no right to examine the books of Chinese firms or the sources of the financial information presented by these firms. This gives Chinese firms the benefit of accessing the world’s deepest financial and capital market without being accountable to the regulatory or legal oversight which is applied to all other companies listed on US exchanges.

The strategic argument is US capital is being deployed to help Chinese firms raise resources to advance Beijing’s industrial and technological plans at America’s expense.

In practice, it is unlikely all Chinese firms will be delisted or banned, or US institutional or pensions funds are prohibited from holding any Chinese firms in portfolios. However, appetite to place restrictions on individual firms or large parts of sectors linked to the advancement of the MIC 2025 program will increase.

It is also worth noting there are broad executive powers available to the president under the 1977 International Emergency Economic Powers Act68 to block transactions and freeze assets in US dollars in the event of an ‘emergency’ and a requirement to respond to ‘unusual or extraordinary threats’. Indeed, Trump has referred to these powers several times, including to compel firms to “immediately start looking for an alternative to China.”69

Of course, excessive or disproportionate use of these powers will increase the perception of sovereign risk with respect to US dollar assets and financial transactions.

2. Restricting Chinese access to markets

The measures against Huawei which restrict its access to the US market, components and software70 is the most notable move when it comes to narrowing access for a Chinese high-tech firm. It will not be the only example. The willingness to work with governments and firms in other like-minded countries (such as Japan and EU nations) to develop credible alternatives to specific Chinese offerings will grow. The objective will be to ensure international dependency on Chinese firms and technologies are minimised through the provision of credible, if not superior, alternatives.

This means even though the United States withdrew from the original Trans-Pacific Partnership (TPP), one of the key mindsets of the TPP might well be revived. The TPP strategy was to use the leverage resulting from the size of the US domestic market to persuade countries to abide by specific rules and standards. This general approach will ensure and be increasingly applied to bilateral and mini-lateral trade agreements. Indeed, in any revision or upgrade of a trade agreement between the United States and another advanced democratic nation, it is almost certain cooperation on enabling and critical technologies will be a high priority to reduce reliance on Chinese options.

3. Restricting Chinese access to innovation and know-how

It is likely the US government will give itself even broader powers to block corporate and sales transactions between American and Chinese firms and the export of whole classes of products or certain technologies such as semiconductors and aeronautical equipment (even if these powers are held in reserve most of the time).71 It is almost certain that a growing number of Chinese firms in the MIC 2025 sectors will be included on the restricted entity list and ever-harsher penalties will be threatened and applied to those violating the restrictions: enormous fines, revocation of US licences, blocking of US dollar transactions and criminal penalties for executives.

Chinese innovation and know-how also depend heavily on joint ventures with foreign firms. One estimate is about 80 per cent of private-sector R&D money spent in China in 2015 — about US$44 billion out of US$55 billion — was by non-Chinese multinationals.72 This will be an increasingly unacceptable situation as it will help China emerge as the global leader in terms of enormous advances in innovation and know-how. Therefore, US attempts to identify and capture a larger share of the supply and value chain across a growing number of emerging and enabling technologies and sectors and deny these to China will accelerate.

The game-plan is already in play. An analysis of tariffs levied against Chinese goods by the White House under section 301 of the Trade Act of 1974 revealed 80 per cent (by value) of the targeted trade with China was in industries identified as “patent-intensive” by the Commerce Department.73 These include computer/electronic products and machinery/equipment, which constitute about 30 per cent and 22 per cent, respectively, of Chinese exports to the United States.74

One of the justifications the United States offered is these are the industries which China heavily targets for forced transfers and IP theft. In addition to targeting Chinese-based firms in these high-value-creating and patent-intensive industries, the tariffs seem designed to make it less commercially attractive for foreign firms to invest in or engage in joint or cooperative ventures with local firms to produce high-value-creating intermediate parts in China. These two broad sectors (computer/electronic products and machinery/equipment) are prominent in integrated regional and global supply chains. Moreover, approximately one-third of all Chinese exports of these products to the United States are directly related to the business operations of American-based firms.75 In other words, around one-third form part of the current supply chains for American-based firms.

Further analysis reveals around two-thirds of these industries’ products imported from China to the United States are produced by foreign-invested firms based in China — mainly US, European and Japanese firms. This is significant because, in theory, these firms do not have to base operations in China. In addition to concerns about IP transfers and theft, tariffs levied on China-based firms make it commercially less attractive for foreign-invested firms to base operations in China when the next or end destination for their product is the United States. The idea is to minimise Chinese involvement — and therefore learning — in prized supply and value chains in certain sectors.

Finally, one should also expect more movement when it comes to further restrictions on visas for Chinese researchers and tertiary students to US institutions in fields such as aviation, robotics and advanced manufacturing.76 It would be surprising if the United States did not exert pressure on other allies, such as Australia, to do the same. Beijing has long carried out a systematic program to acquire expertise and know-how from US and global institutions to advance industrial plans such as MIC 202577 and enhance its military capabilities.78

There are currently around 370,000 Chinese students enrolled in US colleges and universities — up from 98,000 a decade earlier.79 It is improbable Chinese researchers and students will be granted the same level of access when it comes to sensitive and strategic areas of study in the years ahead. Failure to restrict such access will increasingly be perceived as irresponsible by those accepting the reality of comprehensive competition with China.80

4. The importance of Europe

In these contexts, Europe will become the highest priority when it comes to shaping the technological/industrial policies of allies and partners.

The EU does not have decisive and coordinated approaches to preventing the “leakage” of dual-use or critical technologies to countries such as China or encouraging indigenous research and development of such technologies.81 Part of the problem is the prevailing mindset, which is not to confront China, even though there are concerns, including about industrial cyber-theft. This is despite one highly credible study suggesting cyber espionage (mainly, but not exclusively, by China) cost European economies up to US$70 billion in losses in 2018.82 Another study suggests Germany (and South Korea) will be the countries most affected by MIC 2025.83

There are also institutional difficulties. EU positions on industrial and security policies are effectively left to individual members to implement. For example, the EU’s Digital Single Market Strategy and the 2013 Cybersecurity Strategy leave implementation to individual states, so there is no consistent approach. This means regulations and laws within individual countries are not coordinated, which results in various levels of robustness and compliance. Even where there is growing consensus, such as for an EU-wide mechanism to deal with considerable increases in Chinese investment in advanced EU firms since 2015, the lowest-common-denominator approach prevails. This means there is more progress in information sharing than there is in specific and decisive policies to deal with the issue.

In this sense, the EU has been referred to as a “technology piggybank” by some commentators.84 Chinese investment in Europe increased tenfold from 2009–15 and another 76 per cent in 2016. Chinese investment in Germany alone was up tenfold in 2016 from the previous year.85 Chinese firms have bought leading European companies engaged in areas such as robotics, AI, advanced materials, cutting-edge engineering and semiconductors. It has only been in the past couple of years countries such as Germany have started blocking, on national security grounds, applications by Chinese firms to purchase local firms. Even then, the monitoring and review role of national European entities which are equivalent to the CFIUS in the United States is relatively ad hoc, piecemeal, and inadequate. The existence of formal export controls on strategic and/or dual-use technologies (e.g. the 1998 EU Code of Conduct on Arms and 2009 European Communities regime) has not prevented significant leakages of important technologies to China. As has been observed, the controls are interpreted and implemented differently by different states.86 Countries like the Netherlands and France, for example, have tended to interpret them more strictly than Germany in recent times.

Collaborations between European and Chinese entities have also been problematic. European entities have entered into agreements with Chinese entities with little due diligence and unwittingly contributed to the production of systems which have subsequently been used by the People’s Liberation Army. A commonly cited case is the cooperation between the Austrian Academy of Sciences and Chinese counterparts, which contributed significantly to China’s quantum satellite launch in 2016.87

Conclusion

Getting the timeline and chain of causation for the uneasy US-China economic relationship right is important. Despite much attention focused on the disruptive approaches of the Trump administration, China remains far more restrictive and self-regarding when it comes to its policies on industry, market access, innovation and the exchange of people and ideas. It is the Chinese Communist Party which has long been seeking to strike an unequal and unfair bargain with the United States and other countries when it comes to the former’s participation in the global economic system. In its Leninist worldview, which has been reinforced and advanced under Xi Jinping, all public and private activities can be deployed to serve the objectives of the Party and state. This includes all economic activity and how technology is acquired and used.

In Australia and elsewhere in the region, there will be the growing realisation that who we do business with — their political values, institutions, practices and strategic policies — ought to sometimes influence where we do business.

Even so, US-China economic diversification, disentangling and decoupling will not occur in a predictable or consistent manner. Government, politicians and businesses will have different motivations, objectives and timelines, and will not work seamlessly together. Frequently, they will be at cross purposes. Some ill-considered efforts to shift away from China will be unnecessary, self-defeating or even impossible.

But the direction and trends are clear: COVID-19 has magnified and expanded the notion of political and/or commercial risk management to include some level of diversification, disentangling and decoupling from China. Sourcing inputs and producing these from anywhere in the world, minimising inventory, and just-in-time efficiency must give significant ground to different notions of prudence and resilience.

In Australia and elsewhere in the region, there will be the growing realisation that who we do business with — their political values, institutions, practices and strategic policies — ought to sometimes influence where we do business. The greater the impact of the technology or commercial activity on national power and capability, the more regime type of the host nation will come into consideration. We are witnessing the return of the political element in understanding and dealing with different political economies.

.jpg?rect=0,80,3000,1989&fp-x=0.5&fp-y=0.44772296905517583&w=320&h=212&fit=crop&crop=focalpoint&auto=format)