Executive summary

- Advanced capabilities arising from technological developments in quantum, cyber, artificial intelligence, undersea, hypersonics and electronic warfare will be more consequential strategically and available much sooner than Australia’s planned acquisition of nuclear-powered submarines.

- In a more hostile Indo-Pacific, maintaining a leading edge in advanced capabilities will be a decisive factor in the ability of AUKUS (Australia, United Kingdom, United States) partners to offset the risks of a technologically sophisticated adversary.

- To inform an advanced capabilities cooperation agenda, AUKUS partners need to understand areas of comparative advantage, complementarity, and potential gaps or overlaps, between the three industrial bases.

- Each partner needs to be clear about what they can offer and their limits, be willing to harmonise enabling economic and security policy (such as technology transfer arrangements) and understand challenges associated with differing commercial equities.

- Planning needs to have both a short- and long-term focus. The urgency of the strategic environment necessitates the sharing of asymmetric capabilities for more immediate gains. However, the transformative potential of AUKUS is the chance it provides to strengthen defence innovation and the industrial base of all three countries.

- For Australia, AUKUS presents a once-in-a-generation opportunity to bolster its science, technology and defence industry ecosystem. In doing so, Australia can strengthen its foundations for sovereign capability in critical areas.

- Australia has advantages to build on, including research leadership in quantum physics, a skilled workforce, and a stable economy for investment. But it faces serious challenges like flatlining research and development (R&D) funding, poor commercialisation rates, limited depth in the integration of government, industry and academia, and a skills shortage.

- Even if Australia’s key shortcomings are addressed, it cannot be a leader in all high-tech areas. Government needs to be realistic about these limitations and prioritise its investments.

- Australia should focus on force multipliers for the Australian Defence Force (ADF) and areas that build foundations for sovereign capability. This will also allow Australia to cement itself as a valuable contributor to an integrated trilateral AUKUS defence industrial base and allied supply chains in the Indo-Pacific.

Recommendations

- To strengthen Australia’s high-tech ecosystem in support of AUKUS and sovereign capability, the Australian Government should:

- Deepen Australia’s understanding of areas of comparative advantage, complementarity, gaps and overlaps with US and UK high-tech ecosystems.

- Share lessons learned and best practices on models of defence innovation with the United States and the United Kingdom, including to support higher rates of commercialisation.

- Strengthen government, research, and industry collaboration through the establishment of secure high-tech research precincts for each AUKUS advanced capability stream.

- Build Australia’s talent pipeline through a high-tech super mobility program and a new ‘AUKUS visa.’

Introduction

When the dust settled on the September 2021 announcement of the AUKUS (Australia, United Kingdom, United States) enhanced trilateral security partnership, the real work to realise AUKUS ambitions began.1 Policy and media circles largely focused their attention on the most high-profile pillar of cooperation: Australia acquiring conventionally-armed, nuclear-powered submarines.2 However, the second of the two pillars of AUKUS, cooperation on advanced technological capabilities, is even more urgent. Technological developments in quantum, cyber, artificial intelligence, undersea, hypersonics and electronic warfare will be more consequential strategically and much sooner than new submarines. And these technologies will matter not only for military advantage but the economic and political power of states.

The report explains why Australia needs advanced capabilities cooperation as part of AUKUS, what Australia stands to contribute and gain, and how Australia should strengthen its science, technology, and defence industry ecosystem by working with AUKUS partners to advance its military technological edge for both short- and long-term strategic advantage.

Despite the potential significance of the advanced capabilities pillar, critical questions remain unanswered, which require sustained focus and detailed planning in the months and years ahead. How will advanced capabilities cooperation go above and beyond the science and technology cooperation that already occurs through existing bilateral or broader Five Eyes channels?3 What can each AUKUS partner offer to maintain a collective military technological edge, or what does each partner need to fill a critical capability gap? How do AUKUS partners ensure cooperation not only enables procurement of cutting-edge capabilities for more immediate gains but supports a transformative uplift in the science, technology and industrial ecosystems of all three countries? And how can AUKUS partners strengthen interactions between their respective national innovation systems?

Alongside trilateral planning, an even greater task requiring political and bureaucratic attention in Australia is how to prepare the national research, technology, and defence industry ecosystem to capitalise on the opportunities AUKUS presents. A step-change in Australia’s defence industrial integration with the United States and the United Kingdom could add to Australian Defence Force (ADF) capability and create long-term export opportunities for small and medium-sized enterprises in Australian industry. Improved Australian access to, and transfer of, US defence-related technology might address limited opportunities arising from Australia’s involvement in the US National Technology and Industrial Base.4 Strengthened engagement with US and UK research organisations also offers the chance for Australia to learn from best practices and improve its own approach to defence innovation.

Above all else, AUKUS presents the high-level impetus for Australia to uplift its national industrial base to strengthen the foundations for sovereign capability in critical areas.5 Enhanced technological access and sharing through AUKUS will ultimately only be a partial solution for ensuring the ADF is able to field the capabilities it needs to contend with a hostile Indo-Pacific security environment. In certain areas, like advanced manufacturing, guided weapons and sustainment capability, Australia requires higher levels of self-reliance and resilience for critical supply chains. Strengthening Australia’s sovereign defence industrial capability both supports ADF capability needs and helps Australia cement itself as a valuable contributor to an integrated trilateral Australia US UK defence industrial base.

Australia is not beginning from a standing start. Australia’s research, technology and defence industry ecosystem provides good foundations to develop into an even stronger national asset required to support Australian and allied forces. For many years, Australians have undertaken pioneering research in areas like quantum physics while defence scientists and industry partners proved they can work together to commercialise and integrate cutting-edge innovations into ADF capability, such as the CEAFAR phased array radar.6 Australian defence companies export some leading capabilities, like the Australian designed and developed Nulka active missile decoy and the Bushmaster Protected Mobility Vehicle.7 And there is latent potential, including in the civilian technology sector and broader industrial base that can support defence requirements. Industries like cyber and space have experienced rapid expansion. Moreover, there remain untapped opportunities for Australian industry to move along the value chain of technology supply chains through a shift from exporting raw materials to processing downstream inputs, such as the critical minerals necessary for the manufacture of high-end military platforms.

To strengthen its industrial base, Australia must urgently grapple with some critical barriers and challenges through a strategic national reform agenda. Basic and foundational research that could lead to the development of advanced capabilities requires additional investment. Science, technology, engineering and maths (STEM) skills shortages are only set to worsen and need a multi-generational workforce plan. Closer integration of government, industry and academia is essential to foster cultural change around collaboration in support of research commercialisation. Even if these issues are addressed, Australia needs to be realistic that it is a small player in global terms and having some world-leading national capabilities is distinct from having the capacity to be a major market or leader in multiple areas. The government will face hard trade-offs in prioritising technologies and capabilities for investment.

This report sets out a path forward for a whole-of-government policy approach for Australia to maximise advanced capabilities opportunities under the AUKUS partnership. The report explains why Australia needs advanced capabilities cooperation as part of AUKUS, what Australia stands to contribute and gain, and how Australia should strengthen its science, technology, and defence industry ecosystem by working with AUKUS partners to advance its military technological edge for both short- and long-term strategic advantage. The recommendations also have broader payoffs for the industrial base needed to support Australia’s acquisition and sustainment of a nuclear-powered submarine capability.

Why Australia needs AUKUS advanced capabilities cooperation

When the AUKUS partnership was announced on 16 September 2021, the three heads of state, US President Joe Biden, UK Prime Minister Boris Johnson and then Australian Prime Minister Scott Morrison explained that the aim was to “meet the challenges of the 21st century” through deeper diplomatic, security and defence cooperation.8 There had been a faster than expected deterioration in the Indo-Pacific security environment, characterised by strategic competition and unprecedented technological disruption.9

AUKUS partners were particularly concerned by the People’s Republic of China’s (PRC) growing political, economic and military power. The PRC had demonstrated a willingness to coerce and intimidate, undermine established norms, militarise disputed territories, and expand its sphere of influence at the expense of US and allied interests. This was being enabled by the PRC’s advancing technological capabilities supported by a significant investment in science and technology research and development.10 And it was eroding the long-held relative technology advantage of the United States and its partners, hindering their ability to shape and deter PRC behaviour in the region.11

In this fast-moving environment, the time for strategic decision-making has been compressed, and Australia no longer expects a strategic warning time of at least a decade for a major conventional attack. The ADF faces more uncertain peacetime and wartime environments, marked by prevalent and persistent ‘grey zone’ threats enabled by advanced technologies and that manifest short of conflict. These threats include malicious cyber activity against ADF systems, hostile actions targeting space-based assets that support ADF communications, and dis/misinformation campaigns which seek to shape the strategic and tactical information environment in an adversary’s favour.12 Such activities occur alongside other strategic and political threats like economic coercion and foreign interference.

Staying at the forefront of military technological development will be the decisive factor in whether Australia can deter behaviour inimical to its national interests and respond to a range of potential contingencies.

Staying at the forefront of military technological development will be the decisive factor in whether Australia can deter behaviour inimical to its national interests and respond to a range of potential contingencies. The pace and scale of technological change requires fast and agile responses, as there is less time to identify and respond to technical developments.13 Australia needs to be able to quickly develop and/or integrate and use cutting-edge capabilities to maintain a qualitative and asymmetric advantage to offset the risks of a larger, technologically-sophisticated adversary. In many cases, being a fast follower and adopter through procurement of capabilities from Australia’s close partners will be the optimal approach to meet ADF capability requirements. Australia’s success also rests on the ADF’s interoperability with its closest military ally, the United States, and partners like the United Kingdom, and their collective capacities. And it relies on deep and collaborative relationships between government and the private sector, where most innovation occurs.14

If implemented effectively, the advanced capabilities cooperation being pursued through the AUKUS partnership could provide a step-change in Australia’s ability to successfully prosecute its national interests. The initial areas selected for collaboration — quantum, artificial intelligence, cyber, undersea, hypersonics, and electronic warfare — are already having, or are expected to have, a disruptive impact on military technological development.15 They could add to defence and intelligence capabilities, or if wielded by an adversary, erode previous areas of advantage. For example, in the coming decade, advances in quantum computing could jeopardise existing digital encryption systems used to secure military communications.16 The impacts of these technologies will ultimately depend on other institutional, social, legal and ethical considerations, shaping how new technical capabilities are adopted and used.

AUKUS advanced capabilities cooperation also has consequences well beyond the military domain. Many of these technologies are dual-use meaning they have both military and civilian applications. Certain technologies, like artificial intelligence, are general-purpose technologies that enable other technologies like machine learning, and which could potentially transform entire economies and societies. Maintaining a technological edge, therefore, has strategic payoffs beyond creating a military advantage — it fundamentally underpins the economic and political power of AUKUS partners vis-à-vis their potential adversaries.

The state of advanced capabilities: potential applications, prioritisation, and comparative advantages between AUKUS partners

Each advanced capability stream is at a different stage of maturity in terms of technological readiness, ranging from basic and applied research to a proven system ready for commercial deployment. Uncertainty in how these technologies will develop and be used to enhance existing systems or be translated into new military applications should preclude overestimating their potential impact. Instead, such uncertainty demands a realistic understanding of the complexity and timeframes involved in their development. This will also help AUKUS decision-makers determine where it may be necessary to fast-track efforts to respond to current and future threats, and how to prioritise the relative focus on basic research compared with the acquisition of existing capabilities.

Based on the current state of technological development, advances in quantum physics are likely to underpin applications in computing, cryptography, sensing, and logistics management throughout the next decade and beyond. Artificial intelligence supports robotics, logistics management, intelligence analysis and the development of autonomous vehicles. Cyber systems enable capabilities to protect data, encrypt sensitive information, collect intelligence and defend against or prosecute cyber attacks. Undersea capabilities like unmanned underwater vehicles, smart sea mines, and swarm drones are reshaping naval fleet architectures and add to the complexity and congestion of the maritime threat environment.17 Hypersonic systems now being tested, like glide vehicles and cruise missiles, hold potential implications for nuclear deterrence.18 Capabilities to protect access to the electromagnetic spectrum or to degrade or deny the use of the spectrum by an adversary continue advancing.19 A summary of each of the advanced capabilities streams, and their potential or existing military application, is provided in Table 1.

Table 1. Advanced capability streams and their potential or existing military application

|

Advanced capabilities stream |

Technological maturity |

Examples of existing or potential military applications |

|

Quantum |

Strong focus on basic research and technology validation. Further advances are required to make quantum applications dependable and scalable. |

Computing, secure communication and quantum key distribution, decryption, sensing and imaging, position, navigation and timing in GPS denied environments, and supply chain optimisation and logistics management. |

|

Artificial intelligence |

Wide range of proven systems. |

Targeting and vision, robotics, swarm drones, autonomous vehicles, logistics management, intelligence analysis, hypersonic weapon design, automation of administrative tasks, identification of malware for cyber defence and information operations. |

|

Cyber |

Wide range of proven systems. |

Data security, encryption, intelligence collection and malware to support a cyber attack including degrading hostile systems. |

|

Undersea |

Wide range of proven systems. |

Submarines, persistent unmanned underwater vehicle/autonomous underwater systems, smart sea mines, intelligence, surveillance, and reconnaissance, electronic warfare and swarm drones. |

|

Hypersonics |

Prototype development and testing are underway. |

Aircraft, cruise missiles, rocket-launched glide vehicles and counter hypersonic missile defence systems. |

|

Electronic warfare |

Wide range of proven systems. |

Radio communications, microwaves for tactical data links, radars, and satellite communications, electronic countermeasures (jamming), signals intelligence collection, threat recognition, lasers, and electronic attack (on facilities, equipment or personnel). |

Technological advancement in one advanced capability stream will also act as an enabler and force multiplier for other advanced capabilities. As quantum computing becomes more powerful, for instance, it is expected to improve artificial intelligence by training machine learning models to optimise algorithms that can process large datasets. Artificial intelligence can also be used to enhance undersea capabilities by improving the analysis of data from sonobuoys used to detect enemy submarines. Artificial intelligence will also enable other military capabilities such as the Australian designed, engineered, and manufactured unmanned Boeing MQ-28 Ghost Bat (formerly known as the Loyal Wingman aircraft), which is under development and is expected to have the ability to fly independently or in support of crewed aircraft to support intelligence, surveillance, and reconnaissance missions (see image below).20 Understanding these intersections will help AUKUS partners prioritise limited resources toward the technologies that result in the greatest force multiplication effect.

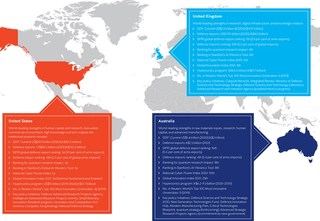

Prioritisation will also depend on a comprehensive understanding of the state of Australian, US, and UK research, technology and defence industry ecosystems. There is a need to identify areas of comparative advantage, complementarity, and potential gaps and overlaps, in each of the advanced capabilities streams across the three countries. Such an assessment is a highly complex undertaking and beyond the scope of this report, but this report can be a launch pad for this critical analysis. As a starting point, and at risk of oversimplification, Figure 1 provides a macro view of key indicators of AUKUS members’ comparative strengths in areas relevant to advanced capabilities.

At the very least this highlights the sheer size and influence of the United States, compared to the United Kingdom and Australia. It also showcases where Australia has the potential to contribute to the AUKUS partnership through its niche scientific research capabilities in areas like quantum physics. A key task for Australia is to better understand its specific areas of comparative advantage and how they can be leveraged to contribute to the ADF’s advanced capabilities needs, as well as fill US and UK advanced capabilities gaps. Likewise, both the United States and the United Kingdom need to be clear about what they can contribute and how they want to see fellow AUKUS partners enhance their own capabilities. This can then inform specific goals and priorities to guide policy decisions to strengthen Australia’s research, technological, and industrial base and support the development of a broader advanced capabilities agenda with US and UK partners.

Figure 1. What each nation brings to AUKUS: A macro view of AUKUS members’ comparative strengths in research, technology and defence industry

Notes: GDP data,21 US defence exports — three-year rolling average for foreign military sales and direct commercial sales,22 Stockholm International Peace Research Institute (SIPRI) arms export data,23 quantum research impact,24 Global AI Vibrancy Tool,25 National Cyber Power Index,26 Global Innovation Index,27 UK defence exports,28 UK policy initiatives29

Australia’s comparative advantages and shortcomings

When considering Australia’s current and future areas of comparative advantage, and possible gaps, it is important not to assess the defence industrial base in isolation. The state of the broader innovation ecosystem holds latent potential and has a direct bearing on Australia’s capacity to build its defence industrial capability. General technological advancement and military technological advancement are interdependent. Australia should harness existing strengths in areas like research and talent, and its growing technology sector, and build on existing areas of advantage in the defence sector specifically, like in manufacturing of naval and aerospace components.30

What follows is an assessment of some key aspects of Australia’s science, technology, and defence industry ecosystem. A snapshot of Australia’s advantages and shortcomings in each of the six advanced capabilities streams pursued under the AUKUS partnership is provided in Appendix A.

Australia’s research environment and talent pipeline

Australia stands out for the quality of its educational institutions and skilled workforce. Australian scientists are renowned for the global impact of their research in fields like quantum physics and artificial intelligence.31 In 2020, Australian research activities resulted in around 3,533 publications per one million population, much higher than the OECD average of 2,090.32 In other words, Australia has a small but educated population.

The number of people in the Australian labour force with vocational education and training or university-level STEM qualifications is also growing.33 A comprehensive study of Australia’s STEM workforce found that of the 11.5 million people in the Australian labour force in 2016, around 16 per cent had a STEM qualification.34 However, this number is still higher for other countries like the United States, where around 23 per cent of the total workforce has a university-level or below STEM qualification.35

Australia remains an attractive destination for foreign direct investment, but the venture capital industry — the sort of financial entities willing to make riskier investments on unproven technology — remains small, less than half of the OECD average.

Australia’s STEM workforce relies on immigration, with 26 per cent of the current vocational education and training (VET)-qualified STEM workforce, and a staggering 56 per cent of the university-qualified STEM workforce, born overseas.36 By contrast, in the United States, foreign-born workers account for 19 per cent of the STEM workforce, although this increases to 45 per cent of the workforce for those with doctoral degrees.37 Although Australia remains one of the most attractive destinations for foreign workers with masters or doctoral degrees, Australia’s STEM skills shortages worsened because of border closures during the pandemic.38 Visa processing times for skilled workers have faced lengthy delays due to the Department of Home Affairs’ capacity constraints, with only three per cent of applications for the engineering-related 476 visa approved in the last financial year.39 This exacerbated existing shortages in the STEM labour force and coincided with a national downward trend in the number of graduates in fields such as engineering and an overall drop in high school student performance in maths.40

Filling gaps in the skilled labour force through a rapid increase in immigration will be essential to strengthening Australia’s industrial capacity, including in the defence sector, alongside longer-term, multi-generational investments in the Australian education system. However, this will remain a strategic challenge, just like it is for the United States, the United Kingdom, and other countries like Germany and France.41 Australia will continue to have to compete for skilled labour with its closest partners. To deliver on AUKUS-related initiatives, a new and more collective approach to pooling and sharing specialist expertise may be necessary.

Australia’s longstanding innovation challenges

Research and development (R&D) is critical to Australia’s technological advancement, generating positive spillovers for productivity growth and national economic competitiveness. Universities Australia estimates that for every one dollar invested in research, five dollars is returned to the Australian economy.42 And yet, Australian Government and business R&D funding is generally flatlining, with only some increases in R&D spending at the state and territory level as well as in specific industries, such as higher education.43 Total R&D spending nationally represented 1.8 per cent of GDP in 2019, well below the OECD average of 2.5 per cent and 3.2 per cent in the United States.44 This is despite Australia’s strong research base and relative growth in its global share of scientific publications.45 In Australia, gross expenditure on R&D was around $35.6 billion46 in 2019-20.47 For comparison, Chinese telecommunications company Huawei invested almost as much on R&D alone in 2021, spending around US$22.1 billion (A$31.9 billion), the largest of any company outside the United States.48

While there is a need to improve Australia’s R&D spending, it also matters how these resources are allocated. Many R&D activities in Australia focus on applied research, which is important for developing new technical capabilities.49 At the same time, resourcing of basic research, necessary for more fundamental discoveries that could catalyse the development of new technologies, has declined.50 According to a US Government Accountability Office report from 2017, the most innovative companies spend about 80 per cent of their R&D on applied research designed to incrementally improve their products, and 20 per cent on disruptive and higher-risk R&D.51 In addition to additional R&D investment, a stronger focus on basic research is vital to support more experimental approaches and disruptive innovation in the long term, even where the direct link to a specific policy priority may be harder to establish.52

Despite the challenges posed by a decline in highly skilled immigration and stagnant R&D investment, Australia’s true Achilles heel is the commercialisation of its research — the so-called ‘valley of death’ between discovery and impact.53 Australia has relatively low rates of knowledge and technology outputs given its strengths in innovation inputs like research.54 Improving Australian research translation could be a catalyst for change in Australia’s technological competitiveness. Australia remains an attractive destination for foreign direct investment, but the venture capital industry — the sort of financial entities willing to make riskier investments on unproven technology — remains small, less than half of the OECD average.55 Australian businesses commonly report this as a barrier to innovation.56 Thresholds for tax benefits intended to stimulate Australia’s venture capital sector were set over 10 years ago, which the Australian Investment Council estimates should be at least 30 per cent higher than current levels based on 2021 inflation rates.57 Consequently, Australian innovations frequently head overseas to larger markets, particularly to the United States, to be monetised.58

Commercialisation challenges go well beyond funding. Networks, collaboration, and integration across different parts of Australia’s innovation ecosystem are critical to removing barriers to innovation — whether spatial, organisational, regulatory or cultural.59 Indeed, the Australian Government’s 2021 National Research Infrastructure Roadmap found closer engagement between Australia’s national research infrastructure,60 industry and end-users is necessary to strengthen commercialisation.61 The Australian National Fabrication Facility (ANFF) provides one example of a model for such engagement. The ANFF facilitates low-cost access to equipment, training, expert assistance, and process development support, and operates as an intellectual property neutral environment. This has resulted in successes like the planned commercialisation of a microscope slide for cancer diagnosis through a new company AlleSense, supported by co-investment from the ANFF and La Trobe University.62

While commercialisation challenges in Australia are stark, they are not unique. For instance, the United Kingdom, France, and Germany have all faced difficulties in translating innovative solutions into their defence organisations or the wider market.63 Many OECD countries have implemented initiatives in recent decades to strengthen the flow between knowledge and resources, such as technology transfer offices, start-up accelerators, and research precincts. There is much Australia can still learn from international partners, and this could be a key early focus as part of AUKUS.

Australia’s defence industrial base

Australia’s defence sector exports are now estimated to be worth $2.5 billion annually, with the United States and the United Kingdom two of the leading export destinations.64 Australia has more than 4,000 defence industry businesses that employ around 30,000 staff.65 Although the sector is growing, it is still relatively small compared to Australia’s export market worth approximately $475 billion and workforce of around 13.4 million people.66

There remains a range of challenges in defence’s innovation ecosystem. These include the extended time it takes to transition a concept to a capability and inadequate commercialisation of Department of Defence-funded research and innovation.67 For instance, in the past six years, less than five per cent of around $441 million in projects funded through the Defence Innovation Hub and its predecessor have resulted in export success.68 Moreover, about seven per cent have resulted in capabilities for acquisition by the ADF.69 While experimentation and failure are a necessary part of the innovation process, it is also important to ensure that the limited funding is expended in areas likely to have the greatest impact. Such issues will be the focus of an independent review commissioned by the Australian Government just prior to the announcement of AUKUS in 2021.70 The review will examine how Defence “can more effectively deliver home-grown, innovative capabilities for the men and women of the Australian Defence Force,” and seek to strengthen links with academia and industry, simplify contracts to support rapid acquisitions, and improve the commercialisation of Defence-funded research and innovation.71

Relationships between different parts of the defence industrial ecosystem (summarised in Figure 2) also do not have the same depth as countries like the United States.72 Over the past decade, Defence’s science and technology organisation, the Defence Science and Technology Group (DSTG), has sought to improve its support to defence science and technology needs including through its engagement with external stakeholders.73 DSTG has also worked to better align its research with force structure priorities and deepen its relationships with industry.74 Targeted partnerships — like the national intelligence community’s collaboration with Central Intelligence Agency-linked, not-for-profit venture capital firm In-Q-Tel — facilitate insight and access to emerging technologies and companies that have the potential to deliver national security capabilities, including for defence.75 But Defence linkages with academia and industry need to go deeper, especially to ensure that the ADF can gain access to the latest innovations in private industry quickly and efficiently for military advantage.

Figure 2. Australia’s key AUKUS players: Mapping Australia’s science, technology and defence ecosystems

Many of Australia’s shortcomings in its defence innovation ecosystem are familiar challenges to its closest partners. In this context, AUKUS provides Australia with the opportunity to deepen its understanding of US and UK models of defence and national security innovation and supporting institutional structures. For instance, the well-known US Defence Advanced Research Projects Agency (DARPA), which received US$3.5 billion (A$5.1 billion) in 2021 to fund research and development activities, provides a model of a high-risk, high-reward approach to the development of technology to drive transformative, rather than incremental change, across the US innovation ecosystem.76 In learning from US and UK partners, Australia can also identify opportunities for greater connectivity between the three ecosystems in support of AUKUS’ longer-term objectives of trilateral defence industrial integration. This will also help support the implementation of the recently elected Australian Government’s commitment to establishing a new research and development agency within Defence, the Advanced Strategic Research Agency (ASRA).77

Defence industrial goals for Australia and AUKUS

Australian industrial policy goals

Australia needs a research, technology and defence industry ecosystem that can deliver the advanced capabilities the ADF needs to respond to the strategic challenges of today, while also preparing for the potential conflicts and contingencies of tomorrow. Given the deterioration of Australia’s strategic circumstances and the reduction in warning time for a major conflict, the capacity of the ecosystem to respond flexibly and deliver quickly has never been more important.

The defence industrial strategy for building sovereign capability must be based on a clear-eyed assessment of Australia’s industrial strengths, as well as its limitations, which the preceding section set out at a high level. It is unrealistic for an economy of Australia’s size, composition and distance from export markets to be a leader across all advanced capabilities areas and across different stages of the supply chain.78 It also cannot afford to do so.79 Nevertheless, it is fair to suggest that Australia could aspire to be a middle-weight international defence industry player and achieve higher levels of self-reliance, if not sovereign capability, in specific and crucial areas like guided weapons and platform sustainment.80 Given that political capital, resources and time are all limited, some clear goals should guide Australian priorities. These can then inform areas for systematic and strategic national reform to maximise Australia’s contributions to, and security and economic gains from, the AUKUS partnership.

In many cases, being a beneficiary of partner innovation and pursuing defence procurement from countries like the United States will continue to be the most cost-effective and appropriate approach to meet ADF capabilities requirements and strengthen Australia’s military technological edge. Australia needs to identify areas of advantage — whether in research or off-the-shelf capabilities — in the United States and the United Kingdom where Australia should seek to be a smart buyer, fast follower and adopter. For example, Australia should leverage US strengths in robotics, autonomous systems and artificial intelligence (RAS-AI) undersea capabilities, like the Boeing Orca autonomous underwater vehicle and Anduril extra-large autonomous undersea vehicles (XL-AUVs).81 Indeed, in May 2022, the Australian Government announced plans to co-fund a $140 million project with US firm Anduril to design, develop, and manufacture three XL-AUVs prototypes in Australia.82 By seeking to co-invest in such projects or offer research or other technical support, Australia can gain access to the programs and encourage direct technology transfer to support the development of Australia’s own industrial capabilities in this area.

There may be some very specific, highly critical areas where Australia desires or requires the sovereign capability to meet its own requirements. Investing in such areas also has the added potential benefit of assuring defence supply chains in the Indo-Pacific for Australia’s partners. For example, Australia is in the process of establishing a $1 billion Sovereign Guided Weapons and Explosive Ordnance Enterprise.83 The project will involve cooperation with defence primes Raytheon Australia and Lockheed Martin Australia, with the aim of developing a sovereign guided weapons manufacturing capability supported by small and medium enterprises within 10 to 15 years.

But sovereign capability and higher levels of self-reliance likely involve substantial costs and government intervention.84 Australia needs to clearly identify and articulate what these areas are and over what timeframe they are necessary to inform trade-offs between financial cost and strategic gain. Sovereign industrial capability priorities, such as those identified by Defence, should be prioritised.85 Australia has limited capacity in areas like manufacturing to support too many priorities.86 Such priorities should also distinguish between those areas where Australia aspires to a higher degree of self-reliance, and where some dependencies on partner industrial capacities and supply chains are considered acceptable, or even beneficial, to share the costs of industry assistance. As sovereign capability requirements are identified, those should be clearly signalled to industry to create opportunities for collaboration and co-investment and help guide business investment decisions. This also needs to be supported by close monitoring to understand emerging capability gaps in areas deemed critical.87

As sovereign capability requirements are identified, those should be clearly signalled to industry to create opportunities for collaboration and co-investment and help guide business investment decisions.

To strengthen Australia’s science, technology, and defence industry ecosystem, Australia’s focus should be on enhancing its existing areas of comparative advantage. That is not to say that Australia should not seek technology transfer opportunities from the United States and the United Kingdom to build new industry expertise. Rather, that it does not make sense for Australia to try and do everything with all the associated investment and time that would be required unless it is considered necessary to address a key strategic or capability risk. For example, it makes sense for Australia to try and build on its current advances in quantum computing and artificial intelligence technologies in areas like robotics and computer vision.88 Staying at the forefront of research in these areas, and all the while improving commercialisation rates, could make an important contribution to the development of military capability. A strength-based approach is ultimately likely to result in more export opportunities, and sooner, for Australia’s small and medium enterprises.

Policy reform should also focus on those issues that are force multipliers. While targeted defence innovation funding programs are important to boost research and support commercialisation, those initiatives alone will be insufficient to uplift the wider industrial base. Broader economic and security policy shapes the environment in which defence prime contractors, and small and medium-sized enterprises, operate. This includes settings on issues such as R&D tax offsets, foreign investment screening, export controls, schemes to attract and retain international students and skilled labour, and expenditure on R&D. Transparent and efficient government procurement processes that encourage fair and open competition, while also supporting local defence industry involvement, have a particularly key role to play in supporting innovation. A whole-of-government approach across a range of portfolio agencies is, therefore, necessary to strengthen Australia’s overall innovation ecosystem, the foundations for Australian sovereign capability in critical areas, and Australia’s contribution as part of AUKUS to a trilateral industrial base.

AUKUS industrial policy goals

Achieving the strategic and military objectives of the AUKUS partnership comes down to the integration of the research, technological and defence industrial base of all three partners in a way that plays to each other’s strengths and addresses areas of gaps or vulnerability. The AUKUS partnership is premised on the idea that the collective defence industrial capacities of the three countries are greater than the sum of their parts. And the partnership rightly assumes that each partner is willing and able to contribute something substantial over the long term to reap the strategic dividends. This has already been highlighted by the willingness of the United States and the United Kingdom to commit to sharing exceptionally sensitive nuclear-powered submarine technology. Advanced capabilities cooperation should similarly focus on technology sharing in areas likely to maximise the capability of one or all partners for collective strategic advantage.

The partnership rightly assumes that each partner is willing and able to contribute something substantial over the long term to reap the strategic dividends.

As a starting point for deeper cooperation, AUKUS partners should deepen their understanding of their respective science, technology, and defence industrial ecosystems. This needs to involve a comprehensive assessment of areas of comparative advantage, complementarity, gaps and overlaps. Discussions on gaps and areas of vulnerability in R&D and defence supply chains will naturally be sensitive. However, given the aspiration of AUKUS to enhance mutual reliance and address barriers to closer science and technology collaboration, this is a necessary part of early scoping work for advanced capabilities cooperation. A key part of this task will also be for each partner to be clear about what they can offer and their limitations. For example, Australia has additional capacity in areas like upstream raw materials inputs to contribute to the partner supply chain but does not have an excess of STEM talent to support skills gaps in the United States and the United Kingdom. In the United States, naval shipyards are already facing a range of challenges including workforce shortages, high operational tempo, limited maintenance and repair training for staff, and shortages in parts and materials — without any added demand from Australia.89 Likewise, in the United Kingdom, the shipbuilding industry is facing skills shortages amid growing requirements for many concurrent projects.90

AUKUS partners should also share best practices and lessons learned from initiatives and projects relating to defence research and commercialisation to help strengthen their respective defence innovation systems. Of course, this already occurs to some extent through existing channels. This includes bilaterally between AUKUS partners, such as the US-Australia Science and Frontier Technologies Dialogue, and specific initiatives like the Australia-UK ‘A Joint Effort’ research collaboration on novel materials for military platforms.91 It also includes broader groupings like the Five Eyes Technical Cooperation Program, which supports deep science and technology collaboration between around 1,000 scientists from Australia, the United States, the United Kingdom, Canada, and New Zealand.92 The focus for AUKUS should be on how to take such cooperation further in a highly trusted, trilateral context.

An early priority for discussion should be a frank exchange on institutional arrangements and structures supporting defence innovation. This should include a critical review of DSTG’s performance in delivering scientific advice and solutions for Defence and the national security community, and the successes or otherwise of the Defence Innovation Hub and Next Generation Technologies Fund. The United States should share lessons learned from DARPA and other similar models, like the Intelligence Advanced Research Projects Activity (IARPA) and the Homeland Security Advanced Research Projects Agency (HSARPA).93 Likewise, the United Kingdom could share insights from the past decade of its Catapult Network research and development centres, its Defence Science and Technology Laboratory including its Defence and Security Accelerator, and early thinking on plans for the establishment of the Advanced Research and Invention Agency (ARIA) intended to fund projects that could produce transformative technological change.94

There is no denying that all three partners have differing commercial equities at play and the desire to maintain and build their areas of comparative advantage and market share. The reality is that Australian companies will ultimately be competing against US and UK firms. The aim should not be to reduce market competition, which is essential for innovation, but to maximise complementarity of approaches wherever possible in support of the collective strategic objective of enhanced trilateral integration.

Policy recommendations for strengthening the Australian ecosystem to meet AUKUS ambitions

To strengthen Australia’s research, technology and defence industry ecosystem in support of AUKUS objectives, a whole-of-government policy approach is required. Creating the right environment for Australia’s defence industry is contingent upon policy settings in portfolios across the Australian Government, and even different levels of government nationally, beyond the Department of Defence. Relevant portfolios include:

- Department of Industry, Science, Energy and Resources

- Department of Home Affairs

- Department of the Prime Minister and Cabinet

- Department of Education, Skills and Employment

- Department of the Treasury

That is not to diminish the centrality and significance of defence policies and programs to support AUKUS’s advanced capabilities work. Instead, it is about recognising that the long-term foundations of Australia’s defence industrial ecosystem are inherently shaped by broader economic and security settings and the state of technological development and economic activity nationally.

Therefore, the following policy recommendations touch on portfolios across government with the aim of catalysing the growth of Australia’s defence industry to capitalise on the advanced capabilities cooperation with the United States and the United Kingdom as part of AUKUS in response to key issues identified in this report.

Recommendation 1: Deepen Australia’s understanding of areas of comparative advantage, complementarity, gaps and overlaps with US and UK ecosystems

Identifying opportunities for closer defence industrial integration among AUKUS partners, and enhancing mutual reliance, depends upon a comprehensive understanding of areas of comparative advantage, gaps and overlaps between the science, technology and defence industrial systems of each country.

The Australian Government should fund Australian delegations to the United States and the United Kingdom in each of the advanced capabilities streams as soon as practicable. Each delegation should be comprised of federal and state officials, as well as industry and academic representatives. To support forthright conversations on sensitive capabilities, it will be important that the non-government delegation members are security-cleared, where possible.

As part of the visits, the Australian delegations should also seek to share information on Australia’s strengths and gaps to support the identification of opportunities for closer collaboration. This could be supported by a comparative advantage assessment undertaken by relevant Australian Government agencies and including research publication, patent and trade data for each of the three AUKUS partners. This will help Australia identify the specific areas of cooperation that it wants to pursue through AUKUS, including what Australia can offer.

Recommendation 2: Share lessons learned and best practices on models of defence innovation, including to support commercialisation

While Australia’s research outputs are high, its broader innovation ecosystem tends to support generally low levels of commercialisation. Australia continues to reform its institutional arrangements to support innovation, including for the defence sector. Australia’s recently elected Labor government has committed to establishing a new research and development agency within Defence, the Advanced Strategic Research Agency (ASRA), modelled on DARPA in the United States.95 Through AUKUS, Australia has an opportunity for candid discussions about lessons learned and best practices with US and UK counterparts, including to support the implementation of ASRA.

The Australian Government should establish an annual Defence Innovation Dialogue under the AUKUS partnership as a channel for sharing best practices on arrangements to support defence research and commercialisation.

The Australian Government should establish an annual Defence Innovation Dialogue under the AUKUS partnership as a channel for sharing best practices on arrangements to support defence research and commercialisation. This should involve senior levels of government representation, ideally at the agency head level, along with relevant representatives from across defence and wider government organisations that play a role in the national science, technology and defence innovation ecosystem.

The dialogue should be a trusted forum for direct exchanges about each partner’s respective experiences and case studies of successes and failures in approaches to help inform improved defence innovation models moving forward. The discussion should include a segment with other key stakeholders in each country’s innovation ecosystem to explore institutional and broader barriers to innovation and opportunities for closer national and trilateral collaboration. This should involve representatives from other levels of government (e.g., state governments in Australia), academia and industry.

Recommendation 3: Strengthen government, research, and industry integration and opportunities for commercialisation through secure high-tech research precincts

Australia has some niche strengths in the research of almost all technologies underpinning advanced capabilities identified under the AUKUS partnership, with notable strengths in quantum physics and artificial intelligence. However, with public investment in research and development stagnating, and universities under significant funding pressure, additional government investment is required.

Resourcing is not the only issue. The institutional structures supporting interaction between government, academia and industry require renewed focus. Australia also needs the right infrastructure to support the translation of research into prototypes and the testing of products at scale, especially for small and medium-sized enterprises that do not have the benefit of their own innovation hubs like the defence prime contractors.

The Australian Government should establish high-tech research precincts for each of the AUKUS advanced technologies areas. A new precinct would not be necessary for hypersonic research, noting the recent establishment of a collaboration facility in Brisbane.96 Funding for each precinct would be informed by the AUKUS comparative advantage assessment (in Recommendation 1) to determine which technologies Australia should focus on, and an assessment of the minimum funding needed to make a difference. Each precinct should be led by DSTG and involve academia, industry and state government representatives.

The government should support the prioritisation of security clearances for non-government stakeholders to enable collaboration on sensitive projects. The precincts would better enable the government to provide insight into capability requirements, help academia ask questions of relevance to Defence and create demand for innovative solutions from industry. They would provide secure infrastructure for basic research, experimentation to understand how different technologies could be applied for military capability, and later-stage product development and testing. They would also facilitate international collaboration with US and UK partners. A wider set of countries could be included where appropriate, such as Japan on hypersonics research, building on existing US-Japan collaboration.97

Recommendation 4: Build a talent pipeline through a high-tech super mobility program and a new ‘AUKUS visa’

Highly skilled workers are the central pillar of Australia’s defence industrial capability and both Australia’s greatest enabler and constraint. Australia faces growing shortfalls in the highly skilled workforce, which has only been exacerbated during the global pandemic. Recent government initiatives will take years for their benefits to be realised.98 If Australia is to ramp up its contribution to AUKUS advanced capabilities work and bolster its foundations for sovereign capability, the government needs to supercharge its approach to growing its skilled workforce and approach talent collectively with US and UK partners.

If Australia is to ramp up its contribution to AUKUS advanced capabilities work and bolster its foundations for sovereign capability, the government needs to supercharge its approach to growing its skilled workforce and approach talent collectively with US and UK partners.

The Australian Government should establish a high-tech super mobility program that fast-tracks Australian visas for researchers and professionals working in advanced capabilities fields. The list of occupations on Australia’s Priority Migration Skilled Occupation List should be broadened to include cyber professionals, electronic warfare specialists, military personnel (from partner nations), and additional occupations in engineering and ICT. Applicants for this program should gain preferential treatment for visa processing. This should be complemented by additional pathways for international students to gain permanent residency and pursue citizenship following the conclusion of their studies. While the goal is to quickly get the right people to Australia, this should not come at the expense of appropriate due diligence checks. A short-term surge in government visa processing capacity may therefore be necessary to scale up visa processing operations.

As part of the broader high-tech super mobility program, Australia should collaborate with US and UK partners on a special three-way Australia-UK-US multi-country visa (‘the AUKUS visa’) for researchers and industry professionals working on AUKUS-related research and programs. Such an arrangement would seek to pool, rather than compete for, workers in highly specialised fields, and provide an enabling arrangement for multi-country research and training programs, engagement and capability sustainment programs in future.

Conclusion

AUKUS presents a once-in-a-generation opportunity for Australia to bolster its science, technology and defence industry ecosystem, and in doing so, strengthen the foundations for sovereign capability in critical areas. Australia has sound advantages to build on, not least in key enablers like human capital and research institutions, and in specific fields like quantum physics. But Australia faces some critical challenges, including flatlining levels of R&D funding, poor commercialisation rates, limited depth in the integration of government, industry, and academia, and a STEM skills shortage.

The Australian Government has a window of opportunity to capitalise on the strong political will, bureaucratic momentum and industry interest to address shortcomings in Australia’s innovation system through a strategic national reform agenda. Creating the right institutional structures to support deeper integration, such as the establishment of secure research precincts, is a starting point for such efforts. Even with increased investment in R&D, as well as more favourable immigration settings to build Australia’s high-tech workforce, the scale of what Australia can achieve will be limited by the size of its population and economy.

Australia cannot be a leader in all areas. Government needs to be realistic about these limitations and prioritise its investments. These should focus on the areas likely to generate the greatest capability advantages for the ADF and US and UK partners as part of AUKUS. At the same time, such investments should also maximise the broader benefits for the nation, especially by focusing on areas where there may be spillovers for the Australian economy, such as investment in basic research to support the development of general-purpose technologies like artificial intelligence.

The true potential of AUKUS is the chance it provides for transformative uplift in the science, technology and defence industry ecosystems in Australia, the United States, and the United Kingdom, and their integration for mutual benefit.

Cementing Australia’s role as a valued contributor to AUKUS hinges on a comprehensive understanding of the comparative advantages, gaps, and areas of complementarity and overlap with US and UK partners. Discussions between government, industry and academic stakeholders are urgently needed to understand what each partner can offer and what each partner needs to fill critical capability gaps. This should inform a balanced agenda of short- and long-term priorities for broader AUKUS advanced capabilities cooperation that go beyond existing collaboration as part of bilateral and broader Five Eyes channels. These priorities could range from Australia’s procurement of existing capabilities such as underwater autonomous vehicles to provide a more immediate asymmetric advantage, to long-term scientific collaboration to develop technologies like quantum over the coming decade.

While there is an urgency to AUKUS cooperation in the deteriorating strategic environment, it would be a missed opportunity to not use the partnership to pursue ambitious and long-term change. That starts with trusted and frank discussions on how to improve respective defence innovation systems. Indeed, AUKUS was born out of the reality that the technological edge of all three partners faces a relative decline in the face of China’s growing technological capabilities. Only a step change in the national and collective approaches of all three partners to technological advancement will alter this trajectory. The true potential of AUKUS is the chance it provides for transformative uplift in the science, technology and defence industry ecosystems in Australia, the United States, and the United Kingdom, and their integration for mutual benefit. Such an approach would not only support the development of cutting-edge military capabilities to respond to a more hostile Indo-Pacific, but perhaps just as importantly, it would strengthen the underlying economic and political power of AUKUS partners vis-à-vis potential adversaries moving forward.

Appendix A: Snapshot of Australian context for each advanced capability stream

Quantum

Australia has notable strengths in its civilian quantum sector, which could be harnessed for military applications in areas like computing, cryptography, sensing, and logistics management. Australia is world-renowned for its quantum research in specific areas like silicon technology, a key input for quantum computing hardware.99 Australia also has strengths in cyber key distributions, magnetic sensing, error correction, clocks, and simulation.100 The country ranks eighth globally for quantum research impact.101 Major partnerships with the likes of the US Department of Defense, Microsoft, IBM, Lockheed Martin and Google support 22 quantum-related research institutions nationally.102 There are now 14 Australian quantum-related companies that have together raised more than $125 million in funding over the past two years.103 CSIRO estimates that Australia’s quantum industry could generate $4 billion in revenue and 16,000 jobs by 2040.104 Defence has sought to capitalise on these strengths by growing engagement with industry and academia to provide insight into capability requirements, signal market opportunities, and support collaboration.105

Yet Australia’s continued success in this field is not assured.106 Australia risks losing its edge as other countries substantially step up their investments in this field, notably China, the United States, France, Germany, and the European Union.107 This has consequences for the country’s ability to attract and retain talent as scientists pursue new opportunities offshore.108 Australians have established some of the largest and most well-funded quantum start-ups, yet companies like PsiQuantum and Xanadu are based in North America.109 Quantum scientists have identified a range of challenges for translating their research in Australia, including differing intellectual property conditions at universities, as well as growing regulatory requirements in areas like export controls, critical infrastructure designations, and foreign investment screening.110 Though these security steps may be necessary to protect the most sensitive research and technology from unwanted transfer, minimising impediments for researchers and industry is key to supporting the growth of a globally competitive industry, as well as to support fast-moving defence capability requirements.

Artificial intelligence

Australia has strong artificial intelligence-related expertise that provides a valuable foundation to leverage for military capabilities in areas like robotics and autonomous systems. Australia is ranked in the top five countries globally for highly cited research in the field.111 Australia has strengths in autonomous robotics technology, cyber-physical systems, and computer vision.112 CSIRO estimates that digital technologies, including artificial intelligence, could be worth $315 billion nationally by 2028 and $22 trillion globally by 2030.113 However, the translation of research into patents remains relatively weak, with an average of 14 patents filed per million of Australia’s population compared to the OECD average of 38 patents per million.114

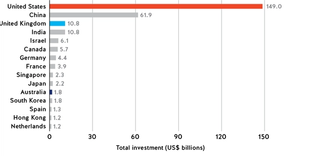

The level and pace of investment by both government and the private sector in Australia also falls short of many advanced economies. Between 2013 and 2021, private investment in artificial intelligence-related companies totalled around $1.8 billion, placing Australia 11th globally (see Figure 3).115 Although the Australian Government has increased its funding through the $124.1 million Artificial Intelligence Action Plan, this falls well behind estimated government investments of roughly $6.97 billion in the United States, $1.87 billion in the United Kingdom, $1.1 billion in South Korea, and $1.3 billion in India.116 The digital sector’s peak body, the Australian Information Industry Association, has also raised concerns that available funding is not reaching businesses quickly enough, contributing to the exodus of talent abroad.117

Figure 3. Private investment in artificial intelligence by country, 2013-2021

A broader challenge of ‘fragmentation’ between research talent and business impacts research translation.118 Better connecting government, researchers, and industry — including on defence specific requirements — is vital. Initiatives such as the Australian Government-funded Defence Cooperative Research Centre for Trusted Autonomous Systems and Defence Artificial Intelligence Research Network, and the Victorian Government-backed Defence Autonomy Centre of Excellence, are intended to help address such issues, though it is too early to assess their impact.119

Cyber

Australia’s growing cyber sector is vitally important to Australia’s capacity to strengthen its offensive and defensive military cyber capabilities. Australia’s cyber sector was estimated to be worth $2.3 billion in 2020, with more than 26,000 workers, and at least 350 cyber security providers.120 An additional 7,000 cyber-related jobs are expected to be created in the economy by 2024.121 Australia’s strengths are in cyber services and products like threat intelligence analytics, secure mobility solutions and cloud hosting.122 Almost half of Australia’s cyber companies are exporting their products and services abroad.123 For example, Kasada, which offers solutions to block bad bots, is one of Australia’s fastest-growing cyber security start-ups that has expanded into the United States and the United Kingdom.124 Kasada has raised around $54 million (US$39 million) in investments, with In-Q-Tel reportedly an early investor.125

Despite the growth of Australia’s cyber sector, foreign companies still occupy a dominant role in the national market.126 Commercialisation rates are much lower than Australia’s relative strength in cyber technology research.127 In AustCyber’s Digital Consensus of 2020, almost half of all start-ups also reported challenges in accessing capital, especially early stage, as well as seed funding.128 Demand for cyber skills is also rapidly outpacing supply. The 2021 International Information System Security Certification Consortium’s recent Cybersecurity Workforce Study found that Australia needs an additional 25,000 workers to address current cyber security gaps.129

Workforce constraints present a key challenge to strengthening cyber capabilities within Defence and the broader national security community, including Australia’s offensive cyber capability in the Australian Signals Directorate (ASD).130 Plans to grow the ASD workforce through initiatives like ‘Project REDSPICE’ will require constant focus to deliver.131 Addressing the pipeline of talent will be key not only to the country’s digital transformation but the ability of government and small and medium enterprises to support defence and national security capabilities in this area.

Electronic warfare

Capabilities to protect access to the electromagnetic spectrum or to degrade or deny the use of the spectrum by an adversary are a critical component of modern warfare and they are continually advancing.132 The ADF possesses advanced electronic warfare capabilities like the EA-18G Growler electronic attack aircraft and F-35A Lightning II aircraft, which will be strengthened through the planned acquisition of the MC-55A Peregrine airborne electronic warfare aircraft. DSTG is the main driver of ongoing electronic warfare-related research and development, in areas, such as advanced laser technologies. As a critical domain for both civilian and military capability, space electronic warfare is a growing area of focus to help assure Australia’s continued access to space-based communications systems, intelligence, surveillance and reconnaissance capabilities.133

Australian companies have also developed some leading radar and surveillance capabilities, such as the CEAFAR phased array radar and Jindalee Operational Radar Network.134 Australia is seeking to grow its sovereign electronic warfare capability within the Australian defence industry. For example, the IIR Surrogate Project, a collaboration between DSTG and DEWC Services, will test electro-optic countermeasures against a new infrared camera capability for detecting aircraft.135 In 2021, Defence also partnered with Flinders University and DEWC Training and Education to establish a $5 million Centre of Expertise for electronic warfare.136 While too early to assess its impact, such initiatives will be important for strengthening electronic warfare education and research programs and helping develop Australia’s electronic warfare talent pipeline.137

Undersea

Undersea capabilities like unmanned underwater vehicles, smart sea mines, and swarm drones are reshaping naval fleet architectures.138 Australia has invested heavily in its naval enterprise as part of major strategies and plans including the 2020 Defence Strategic Update and 2020 Force Structure Plan.139 The Navy’s Robotics, Autonomous Systems and Artificial Intelligence (RAS-AI) 2040 Strategy released in 2020 lays out a more granular approach to strengthening the development of undersea capabilities.140 The Navy’s approach is to “buy small, and buy often”141 to stay at the cutting edge through cheaper and more efficient systems. This includes the acquisition of anti-mine capabilities like the US-developed General Dynamics Bluefin-9 unmanned underwater vehicle and larger Bluefin-12s.142

To strengthen Australia’s undersea capabilities, the naval enterprise will need to grapple with challenges including refocusing after the cancellation of the Attack-class submarine program.143 The Navy also needs to grow its submarine workforce by roughly two to three times its current size, from around 600-720 personnel to an estimated 2,160-2,520.144 Workforce challenges extend well beyond the submarine program. According to the RAS-AI 2040 Strategy, “many essential skills and competencies needed for RAS-AI employment do not currently exist in the Navy.”145 This means that even if Australia has access to cutting-edge undersea capabilities, workforce constraints may impede the ADF’s ability to quickly integrate and deploy them in a meaningful timeframe.

Many underlying technologies that could support Australia’s undersea capabilities are being developed outside of Defence, in industry and academia, as well as with partner innovation ecosystems.146 Leveraging UK and US strengths in RAS-AI programs, and working together to test new technologies (as occurred in May 2022 during Australia-UK-US naval exercise Autonomous Warrior 2022), could address existing Australian shortcomings.147 The United Kingdom is using experimental methods to develop smaller, cheaper, and more lethal systems than crewed platforms.148 Meanwhile, the United States is developing the Orca extra-large autonomous underwater vehicle.149 Collaborating on such projects can support the procurement of capabilities along with inbound technology transfer, providing opportunities for Australian industry to build its own expertise.150 The Australian Government’s plans to co-fund a $140 million project with US firm Anduril to design, develop, and manufacture three Extra Large Autonomous Undersea Vehicles prototypes in Australia provides a model to build on.151

Hypersonics

The successful development and deployment of hypersonic missiles could provide the ADF with a step-change in capability. Hypersonic missiles are more challenging for adversaries to detect and their long-range offers a strong deterrent effect.152 Given the potential implications of such technology, hypersonic research and testing have been a focus of Defence for more than a decade. DSTG’s hypersonics program validated key hypersonic technologies in 2012, and since then, prioritisation and investment have only grown.153 For example, the 2020 Force Structure Plan included between $6.2-9.3 billion for high-speed long-range strike, including hypersonic research, and the recent establishment of a new research facility.154

Collaboration with the United States through the Hypersonic International Flight Research Experimentation (HIFiRE) program155 and the Southern Cross Integrated Flight Research Experiment (SCIFiRE), has been essential to Australia’s understanding of hypersonic scramjets, rocket motors, sensors and advanced manufacturing materials needed for hypersonic cruise missile prototypes.156 Australia’s Woomera Range Complex in South Australia is a national asset in support of such activities due to the vast area available and its capacity to support continuous telemetry collection during test flights.157 It is also an asset where Australia can add to US capacity given their need for testing spaces.158 AUKUS provides the chance to extend this collaboration in a trilateral context with the United Kingdom.

The global context around hypersonics technology is rapidly evolving, with both China and Russia thought to have successfully fielded hypersonic vehicles with potential implications for US and allied missile defence capabilities.159 In May 2022, the United States also successfully tested a hypersonic air-to-ground missile, which is planned to achieve operational status by 2023.160 The issue for Australia, and partners like the United States and the United Kingdom, is speed. There is a need to translate hypersonic research activities into military capabilities quickly and to strengthen defences against the advancing capabilities of potential adversaries.161

.jpg?rect=0,80,3000,1989&fp-x=0.5&fp-y=0.44772296905517583&w=320&h=212&fit=crop&crop=focalpoint&auto=format)